There has been much written recently about companies handing out year-end bonuses after the recent tax cut legislation was signed prior to Christmas.

There has been much written recently about companies handing out year-end bonuses after the recent tax cut legislation was signed prior to Christmas.

Many mega companies such as ATT, Walmart, Alaska Airlines, American Airlines, Comcast and others, proudly announced that they were giving employees an unexpected year- end bonus.

Some of the same companies also announced an increase in hourly wages as well.

Some of the same companies also announced an increase in hourly wages as well.

While this has been viewed as positive for those receiving this unexpected gift, it is estimated only 1% of companies in the US gave out year-end bonuses.

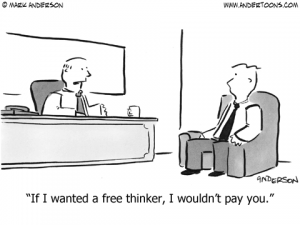

Many pundits and economists are asking the question, why are more companies not sharing the potential upside of the upcoming tax breaks.

They are also asking why more companies are not giving wage increases in lieu of one-time bonuses. “As a worker, it’s great to get a one-off bonus, but that doesn’t guarantee anything for the next year,” said Stephen Stanley, chief economist at Amherst Pierpont. “You’d rather have the raise, because next year you’re working off the higher base.”

While one-time bonuses are nice, they are just that, one-time bonuses, with no commitment to employees that companies will share any future upside with their rank and file workers.

While one-time bonuses are nice, they are just that, one-time bonuses, with no commitment to employees that companies will share any future upside with their rank and file workers.

This makes it more difficult for individuals to plan for family finances. It also makes if difficult to help them deal with the current and looming impact of inflation.

Korn Ferry, an international recruiting and human resource firm, predicted that wages in the US will not change from 2017, where average pay increased 1% adjusted for inflation.

The issue of giving permanent wage increases is more pronounced for middle market companies, as they have higher risk of regional cycles and downturns than larger national or international companies that have significant financial resources.

The issue of giving permanent wage increases is more pronounced for middle market companies, as they have higher risk of regional cycles and downturns than larger national or international companies that have significant financial resources.

Middle market and particularly lower middle market companies have more vulnerability to market fluctuations when they lock in permanent wage increases year over year.

This is especially true in highly cyclical industries where they are required to hire additional employees to keep up with demand and to conduct a significant layoff when business turns down.

This hire and fire cycle in fact creates more uncertainty within the ranks, particularly during the layoff cycle. When this happens, productive or highly skilled workers are likely to leave regardless to find a position in a more stable company.

This hire and fire cycle in fact creates more uncertainty within the ranks, particularly during the layoff cycle. When this happens, productive or highly skilled workers are likely to leave regardless to find a position in a more stable company.

In our practice we find that our client companies are constantly struggling with keeping the right balance of staffing levels. They usually over react by hiring more workers in an up cycle than is required, and in a down turn, are not focused on improving productivity first and then downsizing to the appropriate level.

Given the challenge that lower middle-market companies face with balancing the demand of retaining workers and continuing to operate a profitable business, there is an approach we have implemented successfully with our clients that mitigates this challenge.

First of all, it is important to develop a compensation plan that works for the long term. We believe that a long-term incentive plan should be developed that is focused on accomplishing the company’s profit objectives.

Establishing an incentive plan that is focused on achieving or exceeding quarterly profit targets typically is a significant motivating factor.

Establishing an incentive plan that is focused on achieving or exceeding quarterly profit targets typically is a significant motivating factor.

A certain % increase in base pay for the quarter can be established for achieving the stated objective. If the company exceeds the quarterly target, an accelerating % increase can be established that rewards everyone for an increase in performance.

The accelerator can be fashioned in several different ways depending on the long-term compensation strategy, using different tiers based on the increase over targeted performance.

Obviously, if the quarter target is not achieved, there can be a graduated reduction in the targeted incentive percentage and at some point, no one receives an increase.

Obviously, if the quarter target is not achieved, there can be a graduated reduction in the targeted incentive percentage and at some point, no one receives an increase.

The key factor is to establish frequent evaluation points to provide more frequent motivation.

There are many elements that must be factored into developing an incentive compensation plan, however this concept has many advantages.

The main advantage is that everyone is working together to achieve the company’s profit objective and understands that if objectives are exceeded there is an upside.

The main advantage is that everyone is working together to achieve the company’s profit objective and understands that if objectives are exceeded there is an upside.

The most important element is including all employees, including executives, and communicating the program at the beginning of the year.

Laying out the plan in clear understandable terms is important to ensure everyone is on the same page.

Laying out the plan in clear understandable terms is important to ensure everyone is on the same page.

It’s also important to frequently update everyone on where the company stands in achieving its goals and to pay the incentive quarterly for each quarter it is achieved.

Using the plan as a motivator to improve performance is key.

Establishing a variable incentive plan to mitigate the up and down cycles of a business is important for the long-term health of a company and its employees.

Establishing a variable incentive plan to mitigate the up and down cycles of a business is important for the long-term health of a company and its employees.

Not only does it turn pay increases into a variable cost, it can be a huge motivator for the entire staff having everyone working together to accomplish the company’s goals.

Revitalization Partners is a Northwest business advisory and restructuring management firm with a demonstrated track record of achieving the best possible outcomes for our clients. And now, we’ve written a book to help our readers understand the issues facing their businesses. You can find this compilation of our business thoughts at:

https://revitalizationpartners.com/we-could-write-a-book/ or on Amazon.

We specialize in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations.

Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.