It is generally incorrectly assumed that business cycles arise out of the free market system.

But rather they are the consequence of the expansion and contraction of using unsound money and credit.

But rather they are the consequence of the expansion and contraction of using unsound money and credit.

Since 2013, an average of 37 private credit funds has raised $22 billion of capital every quarter and this trend shows little sign of slowing.

By the start of Q3, there were more than 300 private debt funds actively raising in excess of $130 billion in capital; 60% targeting North America.

Middle Market Credit Expansion …

No segment of the debt capital markets has grown or evolved more than middle market credit.

No segment of the debt capital markets has grown or evolved more than middle market credit.

The dramatic increase in the number of lenders and the capital allocated to middle market direct lending, has increased the competition for loans.

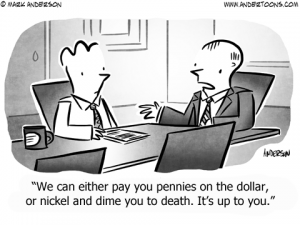

This increased competition for loans has led to compressed yields and very borrower-friendly structures with minimum or no covenants and relaxed due diligence.

Boom and Bust Cycles …

However, the credit cycle is a repetitive boom and bust phenomenon. The bust is the market’s way of eliminating unsustainable debt created through credit expansion.

However, the credit cycle is a repetitive boom and bust phenomenon. The bust is the market’s way of eliminating unsustainable debt created through credit expansion.

If the bust does not occur, trouble accumulates for the next business and credit cycle.

Traditional lenders (banks) have also benefited from the current market expansion. Competition for new loans, increased liquidity at traditional lenders, and an increased appetite for middle-market loans has moderated problems within traditional bank portfolios; a trend that is likely to continue.

Risk has shifted from banks to private lenders as challenged loans that no longer have a home within banks are often able to find financing from private lenders.

Private lenders are often more selective than traditional banks.

These lenders are often industry and geographic specific, and these challenged loans are very often storied credits.

Long before attempting to broadly “shop” a loan such as this, it is critical to make certain that the underlying company has a story to tell that will be received by the lender.

Knowing the characteristics of the lender is critical lest the loan becomes “shopworn”.

Next Crisis Trigger?

Today, economic distortion from the past economic crisis have accumulated to the point where only a small rise in interest rates will be enough to trigger the next crisis.

Today, economic distortion from the past economic crisis have accumulated to the point where only a small rise in interest rates will be enough to trigger the next crisis.

When the next restructuring cycle arrives, whenever that may be, it will be met by a lending ecosystem that is significantly different than during the last financial crisis.

This means that the majority of the issues are likely to be concentrated with the private lenders.

At first blush, the result seems to be a market share shift in favor of traditional banks owing to a shift in the underlying liquidity of traditional banks as compared to private lenders.

As banks look to resolve challenged credits within their portfolio, the refinancing or secondary sale of a debt position to an private lender is likely to be more challenging given that the alternative lender sphere will be dealing with problem credits of their own, and will be less interested in absorbing more troubled credits.

Without the private lender relief valves, banks will resort to traditional approaches to work out – rehabilitation or monetization through a sale of the company.

In the event of a sale of the company, the post-sale financing will be more likely to be provided by a traditional bank lender, again owing to the relative liquidity position of bank lenders.

A Change In Control …

Credit resolution situations in alternative-lender portfolios will also be more likely to result in a change of control and (for the same reasons cited above) the post-sale financing will be increasingly likely to be provided by traditional bank lenders rather than private lenders.

A deeper analysis of the impact of the next cycle casts some doubt, however, that bank lenders are set to regain market share.

A deeper analysis of the impact of the next cycle casts some doubt, however, that bank lenders are set to regain market share.

In recent years, another interesting trend has emerged, which could serve to couple the fate of credit funds and banks. Banks have made loans to alternative lenders at the portfolio level.

If the next credit cycle is significant, these loans may serve as a conduit for distress for private lenders looking to their way into the traditional bank market as well.

The result will be an across-the-board reduction in liquidity, akin in many ways to the last financial crisis.

Must Have A Plan …

What does this mean for middle-market companies? If you have a solid banking relationship, have a discussion as to how your relationship may change during a business downturn.

What does this mean for middle-market companies? If you have a solid banking relationship, have a discussion as to how your relationship may change during a business downturn.

Before having that discussion, it is critical to have a plan for how you will, under those circumstances, meet your credit obligations.

If you have a “storied credit” and are seeking new credit relationships, make certain that you work with an advisor that both understands your situation and has relationships with both banks and alternative lenders to maximize your loan opportunities.

The next credit downturn is coming, despite the current credit boom. Enjoying the boom while being prepared for the bust may make the difference between success and failure of your company.

Revitalization Partners is a Northwest business advisory and restructuring management firm with a demonstrated track record of achieving the best possible outcomes for our clients. And now, we’ve written a book to help our readers understand the issues facing their businesses. You can find this compilation of our business thoughts at:

https://revitalizationpartners.com/we-could-write-a-book/ or on Amazon. We specialize in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations.

Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.