Over the past year, several of our clients have asked Revitalization Partners to assist them in raising additional debt for their companies.

Over the past year, several of our clients have asked Revitalization Partners to assist them in raising additional debt for their companies.

In most of these cases, the company has either outgrown its current debt facilities or hit a roadblock and needs funds for restructuring.

In any case, the current lender has declined to lend additional funds.

THE EQUITY INVESTORS VIEWPOINT …

As some of these companies are owned by or have large investments from private equity funds and these funds have often added to their original investment through bridge loans or additional equity, they would like to see the company borrow the additional money needed.

As some of these companies are owned by or have large investments from private equity funds and these funds have often added to their original investment through bridge loans or additional equity, they would like to see the company borrow the additional money needed.

In other cases, the board of directors prefers debt to equity as they do not want to see their equity positions in the company diluted.

What equity holders often fail to understand is how differently they see the company and its prospects from that of a banker.

Equity holders invested in a company to benefit from that company’s long-term growth. They believe in the future of the company, and even in the case of a downturn or hiccup, they believe that they can make the changes that will, in the end, bring a benefit that will increase the value of their investment.

THE LENDER’S VIEWPOINT …

Lenders view a company very differently. Their return consists of getting their money back along with the agreed-upon interest payment.

Unlike investors, they only look at the company’s historical performance to determine if, based on that history, the company will be able to pay back the loan in the future.

Unlike investors, they only look at the company’s historical performance to determine if, based on that history, the company will be able to pay back the loan in the future.

No matter how well the company does in the future or how much the value of the equity becomes, unlike equity investors, a lender is only entitled to repayment of principal and interest.

In many cases, the company may have a senior secured lender already in place. A senior secured lender has a lien on the assets of the company; in most cases it is receivables and inventory.

In some, it is equipment and real estate. But should something go wrong, and the company is unable to make the agreed-on loan payments, the senior lender can seize the collateral and sell it to recoup its loan.

SUBORDINATED OR MEZZANINE DEBT …

In other cases, the company needs funds in addition to those supported by the assets or collateral. This is where we hear the term subordinated or mezzanine debt.

These are lenders that will loan a company money that is only secured by any assets of the company beyond those that the senior lender might have to sell to recoup its loan.

These are lenders that will loan a company money that is only secured by any assets of the company beyond those that the senior lender might have to sell to recoup its loan.

In many cases, there are not assets to cover the loan, so the lender is totally dependent on the cash flow of the company that is above its operating expenses and existing debt. These loans are more expensive than secured debt and the due diligence of the lender is greater.

The problem often arises when the investor believes it has dealt with the problems of the company and now needs to borrow the money to execute the company’s plan. The company puts together a plan, the investor believes in that plan, but the execution of the plan hasn’t happened yet.

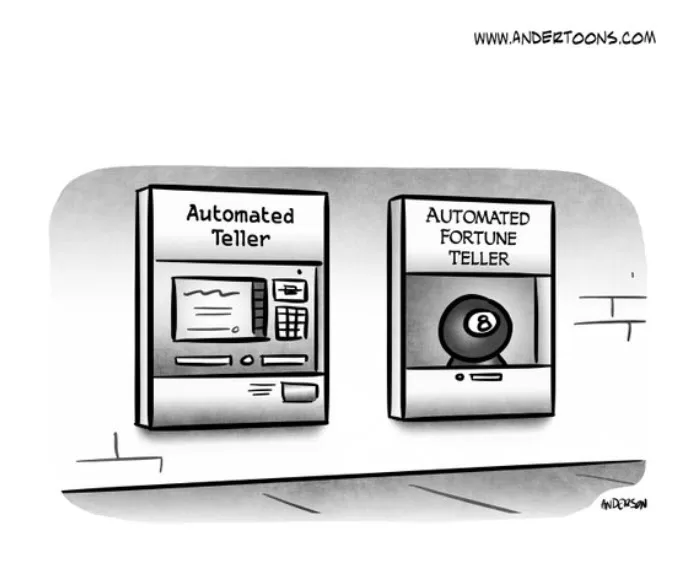

The lender looks at the performance of the company, the amount of secured debt the company has and the historical and current cash flow. The investor sees the upside, the lender sees the risk. The investor wants to have the lender view the future the way that it does, while the lender would like the investor to see the risk that it sees.

DO YOU SPEAK BANKANESE?

What is needed here is the ability to speak, as the title of a webinar we did a few years ago, “Bankanese.”

What is needed here is the ability to speak, as the title of a webinar we did a few years ago, “Bankanese.”

The role of a third party such as Revitalization Partners is to ensure that investors and the company understand the lender’s issues and that the prospective lender understands why the investor believes in the future as strongly as it does.

Matching lenders, companies, and investors is also critical.

Lenders, especially Mezzanine or subordinated lenders, often have industries that they understand better than others.

Some have both lower and upper limits as to the amount of a single loan. It does no good to focus on a presentation to a lender whose interest starts at 5 million dollars, if you can only support a two-million-dollar loan.

The exception to the above is where the party approaching the lender has a relationship with the lender and has brought them successful loans.

“Like any other part of business, successful relationships count.”

Whether you’re an investor looking for a loan or a lender looking at a loan, being willing to listen to and understand the other parties thinking is critical to success. And speaking Bankanese doesn’t hurt.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.