The Paycheck Protection Program (PPP), along with other federal and state initiatives, helped many business stay afloat during the COVID-19 pandemic.

Now that the U.S. Small Business Administration (SBA) stopped accepting new PPP applications from most lenders almost a full month before the $292 billion program’s application deadline, where can a company turn?

PPP ALONE NOT ENOUGH?

Even for those that survive COVID-19 and were able to secure PPP funds, it may not have been enough. For many companies, lack of liquidity will remain a significant problem, impacting normal business operations.

Lower staffing levels, disruption in the supply chain, stretched receivables and payables, and decreasing inventory levels all contribute to out-of-formula positions and covenant defaults with lenders.

Lower staffing levels, disruption in the supply chain, stretched receivables and payables, and decreasing inventory levels all contribute to out-of-formula positions and covenant defaults with lenders.

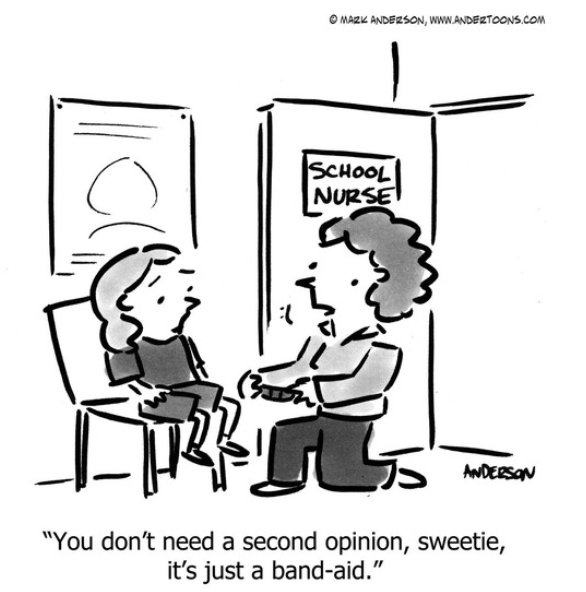

PPP money was only a band-aid meant to cover payroll and some overhead expenses for a short period and unlikely enough to meet all a company’s future cash needs. Many will need additional support or investment from their lender or a third party to restart or continue operations.

And those companies that have failed to make the necessary long-term changes in their liquidity structure may find themselves not having a viable solution for their financial needs.

NOW LOAN FORGIVENESS …

Lenders that have processed PPP loans are now dealing with the PPP loan forgiveness applications and have not addressed the myriad of expected issues with their borrowers. The latest round of PPP loans has extended this problem.

Lenders that have processed PPP loans are now dealing with the PPP loan forgiveness applications and have not addressed the myriad of expected issues with their borrowers. The latest round of PPP loans has extended this problem.

Sometime during the third and fourth quarter, however, lenders will review their loan portfolios and decide which clients they will work with to restructure their loans due to covenant defaults, out of formula loans and/or requests for additional financing.

Others will be asked to seek an alternative source of financing.

To buy additional time to refinance their loan relationship, they may be asked to enter into a short-term forbearance agreement which may include additional terms, reporting, and higher pricing. Some businesses may even be forced to sell or close their operations. Multiples, however, will be lower resulting in a discounted selling price from pre-COVID-19 valuations.

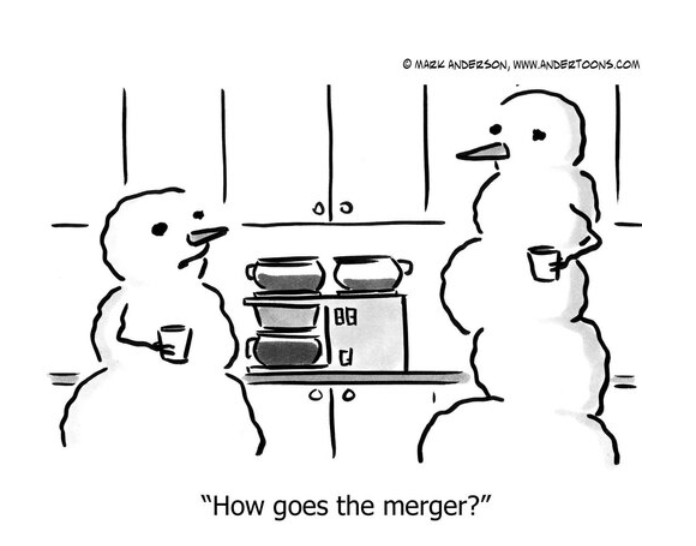

MERGING COMPANIES …

Merging with another company is a consideration, but it can take time to find the right partner, conduct due diligence, and negotiate a mutually acceptable agreement. Others will have no other option but to file for a State Receivership or bankruptcy and reorganize.

Bankruptcy can be very expensive, and few survive over the long term. Additionally, the stigma of working with a company who is reorganizing while in bankruptcy may not have support from their lenders, vendors, and customers to stay in business. Some companies will just close their doors forever.

Management should rely on trusted advisors (attorney, CPA and/or turnaround consultant) to explain the best options available.

Accurate and timely financial and collateral information must be available to prepare a plan and help negotiate a deal either with the bank or an alternative source of financing.

WHEN YOUR BANK SAYS “NO” …

If a bank says no, and is unwilling to continue working with a business, there are alternative sources of financing for businesses requiring working capital.

If a bank says no, and is unwilling to continue working with a business, there are alternative sources of financing for businesses requiring working capital.

This option is usually in partnership with a factor or asset-based lender who finances the invoices to pay off the PO lender and provides additional working capital going forward.

An asset-based lender leverages the receivables, inventory, machinery, equipment, and real estate of a business on a formula basis to pay off its existing lender and provide additional working capital.

An asset-based lender leverages the receivables, inventory, machinery, equipment, and real estate of a business on a formula basis to pay off its existing lender and provide additional working capital.

These lenders provide financing to companies with high leverage, weak balance sheets or those that have experienced losses but are still viable.

These businesses should be able to show their operating performance and plan to return to profitability.

While the pricing is almost always more than a bank, asset-based lenders can provide critical and essential access to working capital.

BEST TO START EARLY” …

It’s best to begin thinking about financing options early before the cash need arises. Lenders need time to conduct diligence, get approval, and document the agreement.

It’s best to begin thinking about financing options early before the cash need arises. Lenders need time to conduct diligence, get approval, and document the agreement.

Waiting too long to obtain financing can result in further disruption and missed opportunities to operate and grow the business.

It’s smart to have a Plan B to finance working capital needs when PPP isn’t enough.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.