This article, by Revitalization Partners, was first published in the ABL Advisor.

Nine months ago, Revitalization Partners began hearing of ominous warnings from management insiders, many of whom were forecasting a 2020 recession.

Nine months ago, Revitalization Partners began hearing of ominous warnings from management insiders, many of whom were forecasting a 2020 recession.

It was not that startling to us, given that we had written about the factors that could produce a downturn in various blog posts. However, those collective observations were running counter to the news of the day.

The country was doing great – experiencing full employment, confident consumers, a robust housing market and low interest rates.

To be fair, there were signs of headwinds as well, such as the government’s obsession with imposing tariffs on our trading partners, an upcoming presidential election and considerable uncertainty To in the stock market.

The issue at the time was if and/or when companies started to cut back on spending and reducing inventory levels, those emerging challenges would serve as the forewarning of economic problems to come.

OTHER TROUBLING SIGNS …

Other troubling signs started to surface: In late 2019 a Fortune/Survey Monkey surveyed senior managers at companies ranging from Fortune 500 concerns to small businesses in diverse industries.

Other troubling signs started to surface: In late 2019 a Fortune/Survey Monkey surveyed senior managers at companies ranging from Fortune 500 concerns to small businesses in diverse industries.

One of the key findings was that two out of three executives believed a recession was likely within the next twelve months.

While there were several bright spots in the economy at the time, the consensus was that the good times would not last forever.

Coincidentally, it was December 2019 when the first COVID-19 case was reported in China and by the end of January 2020 the World Health Organization declared the highly transmissible virus a global health emergency. The first case in the USA was reported in January as well.

Coincidentally, it was December 2019 when the first COVID-19 case was reported in China and by the end of January 2020 the World Health Organization declared the highly transmissible virus a global health emergency. The first case in the USA was reported in January as well.

As it turns out, the concern that managers had in late 2019 would translate into a major transformation and upheaval of business much sooner than even they had predicted. A number of key economic indicators essentially crashed in a remarkably short period of time.

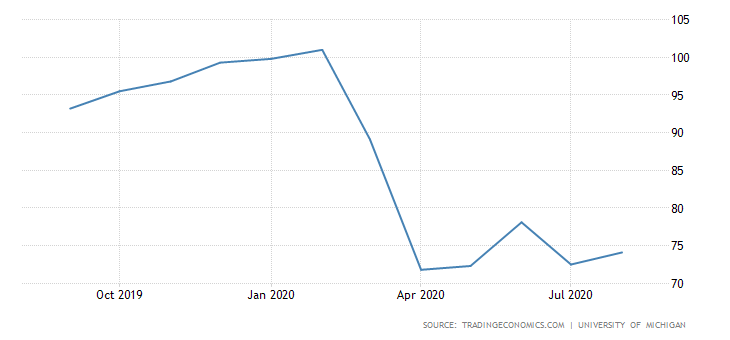

The Dow Jones Industrial Average dropped 38% in 40 days, unemployment soared from 3.5% in February to 14.7% in April, and consumer confidence plummeted 29% from February to April.

MOST BUSINESSES WERE UNPREPARED …

Most businesses were unprepared to deal with the economic free fall. In fact, small- to middle market companies experienced the most significant declines and were generally ill equipped to deal with them.

Most businesses were unprepared to deal with the economic free fall. In fact, small- to middle market companies experienced the most significant declines and were generally ill equipped to deal with them.

In retrospect, one might ask what could these businesses have done to prepare for such a drastic downturn?

Given the dramatic rate of change, some might question what, if anything, they could have done to mitigate the financial impact.

Our response to that rhetorical question has never wavered: Always have a Plan B – even in good times.

In the world of business, where both startup and established companies deal with daily struggles and sometimes risk everything to succeed, having a Plan B may be considered a weakness or seen as a lack of commitment to the current plan.

In the world of business, where both startup and established companies deal with daily struggles and sometimes risk everything to succeed, having a Plan B may be considered a weakness or seen as a lack of commitment to the current plan.

Having a contingency plan is nothing new, however, especially to those organizations and individuals willing to take great risks for a chance at even greater gains.

Dating back to the Civil War, the art of contingency planning took on supreme importance in case the optimal plan of attack did not work out.

VIEW AS A STRATEGY …

Even though you hope that you will never have to resort to your back-up plan, this does not change its importance since you might have to rely on it in the future.

Even though you hope that you will never have to resort to your back-up plan, this does not change its importance since you might have to rely on it in the future.

The process itself will often cause you to rethink your primary plan and be in a position to improve it.

Intentionality is what makes any contingency plan effective. Executives who are often risking it all to survive in the business world, regardless of sector or industry, should view their back-up plan as a strategy, not an afterthought.

It requires you to take a personal inventory of what is important to you and finding ways other than Plan A to help achieve your goals.

CRITICALLY ASSESS YOUR BUSINESS …

The last point is particularly important, as developing a Plan B forces management to assess their business critically. As part of this process, they must understand where they have vulnerabilities.

This might include assessing the risk of high customer concentration, weakness in their supply chain, determining the risk of losing key management members, the lack of online ordering and delivery systems, as well as weakness in their information technology systems.

This might include assessing the risk of high customer concentration, weakness in their supply chain, determining the risk of losing key management members, the lack of online ordering and delivery systems, as well as weakness in their information technology systems.

By identifying these vulnerabilities, management in fact may decide they must take action sooner, rather than later, to make important changes in advance of the next business decline.

Take it from former CEO’s that have helped numerous companies deal with the consequences of poor planning: You don’t want to be the person in the board or management meeting that says, “We should have listened – and been prepared!”

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.