The term Zombie company was originally used by Japanese media around 1990, to describe companies with large historic debts that ultimately failed and resulted in the country’s 1990 market crash.

The term Zombie company was originally used by Japanese media around 1990, to describe companies with large historic debts that ultimately failed and resulted in the country’s 1990 market crash.

The definition of Zombie companies relates to businesses that are highly leveraged, and are generating sufficient cash to fund operations, however, are not able to repay their debt when due.

Their lenders and/or investors continue to support these companies by granting forbearance or by extending repayment terms in hopes that the business outlook will improve.

The real truth is, those companies are in effect insolvent, or dead, and therefore become Zombies.

ONE COMMON DENOMINATOR …

Zombie companies come in many forms. They can be startups funded by venture capital firms, family businesses, privately-owned companies, or companies owned by private equity firms.

While Zombies come in all shapes and sizes,

there is always one common denominator,

high debt leverage relative to cash available

to fund operations and debt service.

A recent article in Forbes magazine highlighted that corporate debt of large nonfinancial US companies is nearing $10 trillion and small, medium, family, and other businesses not listed in the stock exchanges carry an additional debt of $5.5 trillion.

A recent article in Forbes magazine highlighted that corporate debt of large nonfinancial US companies is nearing $10 trillion and small, medium, family, and other businesses not listed in the stock exchanges carry an additional debt of $5.5 trillion.

The total of nearly $15.5 trillion, results in an average debt to equity ratio of 84%.

A recent CNN article written prior to the COVID-19 crisis revealed that 1 out of every 8 companies in advanced world economies met the definition of a Zombie company.

THE COVID-19 CRISIS HAS …

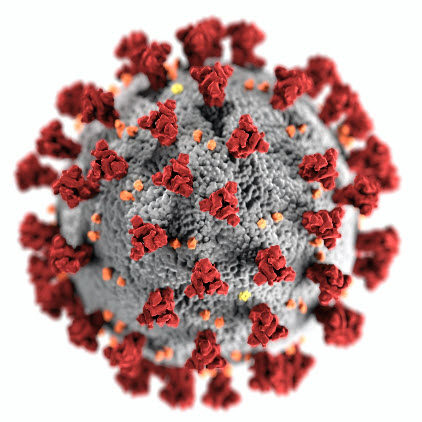

Regardless of the reasons for highly-leveraged companies, the COVID-19 crisis has significantly increased the number of Zombies, although there have been no recent statistics showing how many more companies are almost dead.

Regardless of the reasons for highly-leveraged companies, the COVID-19 crisis has significantly increased the number of Zombies, although there have been no recent statistics showing how many more companies are almost dead.

The central focus here is that while the number of distressed companies has accelerated since the beginning of the year, what can and should be done to deal with this growing epidemic?

THE 1ST QUESTION TO ASK …

The first question that has to be asked is can the Zombie be resuscitated? Can it be brought back to life?

The first question that has to be asked is can the Zombie be resuscitated? Can it be brought back to life?

This question requires that the responsible fiduciaries make an assessment of the company’s viability.

In other words, is the company better off alive or dead?

It is a common truth (at least with companies we worked with) that life-threatening problems are not always dealt with in a timely manner.

Typically, resolutions to operating problems are pushed off, in the hope that things will get better although they usually do not. This issue always compounds the problems and in today’s environment, the term “Hope is Not a Strategy” is even more relevant.

RESPONSIBLE PARTIES MUST ACT …

An honest assessment is required by the responsible parties to make this determination. And an honest assessment includes a thorough and objective evaluation of the company’s near-term prospects.

When you are a Zombie, it does not help to look at the long term! Responsible parties should also seek outside help in assessing the near term prospects, to ensure objectivity.

When you are a Zombie, it does not help to look at the long term! Responsible parties should also seek outside help in assessing the near term prospects, to ensure objectivity.

If, at the end of the day, the assessment reveals there are no options to revive the company, the responsible parties must look at all alternatives to maximize the return to its creditors.

Remember, when a company cannot pay its debts when due, the fiduciary responsibility shifts from the shareholders to its creditors. Companies in this situation must act quickly as the value of the company’s assets declines rapidly.

Remember, when a company cannot pay its debts when due, the fiduciary responsibility shifts from the shareholders to its creditors. Companies in this situation must act quickly as the value of the company’s assets declines rapidly.

It is also important to reach out to a firm experienced in helping responsible parties assess their situation and who can suggest alternatives for improving the return to its creditors.

If one believes a company you are affiliated with is headed towards the Zombie World, it is extremely important to evaluate options for improvement before its too late.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.