While many of Revitalization Partners’ assignments relate to helping companies with banking and financial situations including receiverships and bankruptcies, others are assignments that involve serving as senior operating managers to help companies return to a solid business track.

While many of Revitalization Partners’ assignments relate to helping companies with banking and financial situations including receiverships and bankruptcies, others are assignments that involve serving as senior operating managers to help companies return to a solid business track.

Some of our experience has been in large retail businesses, a large international solar distributor, home centers, marine repair and software and hardware in high tech.

SERVING AS CEO or PRESIDENT …

In all of these, serving as CEO and/or President, the subject of employee compensation raises its head. Who gets the raise and who, if necessary, gets the layoff or termination?

In all of these, serving as CEO and/or President, the subject of employee compensation raises its head. Who gets the raise and who, if necessary, gets the layoff or termination?

Employee compensation can be an emotional subject, especially if you’re the employee.

It is often daintily tiptoed around in interviews and loudly complained about in bars.

As managers, we firmly believe that compensation reflects an employee’s value to a company. As value goes up, so does pay.

IF EVERY COMPANY WERE AS …

When we express these opinions, however, we often get disgruntled rebuttals like:

> “Yeah, right. Corporations have no concept of loyalty”,

> “Layoffs are completely arbitrary-it doesn’t matter what you’re worth” and

> “The only way to get a raise is to change jobs!”

Since these complaints are made to the one of us serving as the CEO of a company that clearly isn’t so callous – it’s obvious that these stereotypes cannot be universal.

Putting aside this irony, though, even if every company in the world were as ruthless and coldblooded as some believe, value and compensation would still be inextricably connected.

Putting aside this irony, though, even if every company in the world were as ruthless and coldblooded as some believe, value and compensation would still be inextricably connected.

Let’s take a look at why this is the case and how you can increase your value as an employee to get paid what you deserve.

THE MOST EVIL OF SUBJECTS …

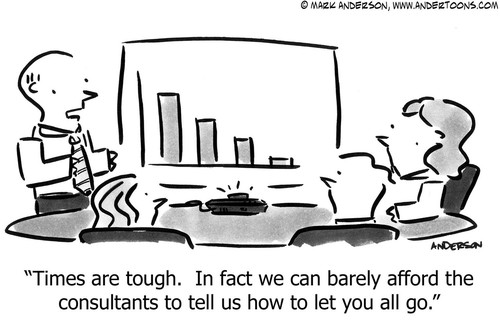

We’ll be a fly on the wall in that dim, coffin-shaped room where lanky, investment centered business misers drum their spindly fingers together and cackle over that most evil of subjects: layoffs.

In our hypothetical case, when they discuss the customer support function, they decide they need to lay off one person, and gradually narrow the options down to two employees:

In our hypothetical case, when they discuss the customer support function, they decide they need to lay off one person, and gradually narrow the options down to two employees:

“Kevin” is an old-and-true company standby. He’s worked at the company for 20 years and has been completely faithful to his job expectations. He clocks in and out on time and delivers his customer support perfectly on script. As a result, he’s accumulated a number of raises over the years and now makes $20 an hour.

“Shelly” has only worked in customer support for five years but has obtained advanced technical certifications, has an excellent interpersonal manner, and routinely turns upset customers into loyal patrons. Clients who get support from her are 30% more likely to purchase additional services and to refer friends.

“Shelly” has only worked in customer support for five years but has obtained advanced technical certifications, has an excellent interpersonal manner, and routinely turns upset customers into loyal patrons. Clients who get support from her are 30% more likely to purchase additional services and to refer friends.

She talks off script a fair amount but keeps track of what she says and how customers react. As a result, she has submitted many helpful modifications to the basic IT script, resulting in a 10% increase in customer satisfaction for the whole floor. Due to her high performance, Shelly also makes $20 per hour.

Which one gets the boot?

THEY’RE LOSING $$$ ON WHO?

It’s Kevin without question. The company is actually losing money on Kevin. If they fired him, a new employee would work for only $15/hour and could read the script just as skillfully as Bill does within two weeks.

It’s Kevin without question. The company is actually losing money on Kevin. If they fired him, a new employee would work for only $15/hour and could read the script just as skillfully as Bill does within two weeks.

If Shelly were fired, however, the company would lose out on a major source of sales, referrals, customer satisfaction, and an internal system for improving the whole department-they can’t afford to lose her!

It’s important to note that for every dollar that an employee hopes to get in increased pay, they need to bring in three to five dollars to the business for that raise to make sense.

But what about faithful old Kevin? It would be so mean to fire him! Kevin’s problem is that he hasn’t really done anything to justify his increased wages. Small raises have accumulated on his paycheck like moss on an old river rock, but his real value is still around $15 an hour.

But what about faithful old Kevin? It would be so mean to fire him! Kevin’s problem is that he hasn’t really done anything to justify his increased wages. Small raises have accumulated on his paycheck like moss on an old river rock, but his real value is still around $15 an hour.

However, since Kevin has been working at the company for so many years, he probably “feels” like he’s worth $20 an hour. Never mind the fact that he couldn’t get paid $20 an hour at a different company, he’s “put in his time,” so he’s worth $20 an hour, right?

WHOSE FAULT IS IT THEN?

But whose fault is this really? Maybe if Kevin’s management had a higher standard than “doing the minimum”, Kevin might have grown with the job or realized he was in the wrong spot.

This is definitely not trying to understate the value of experience and wisdom. Good employees learn and grow over time, so they provide more value for their employer. As a reward, they get raises.

This is definitely not trying to understate the value of experience and wisdom. Good employees learn and grow over time, so they provide more value for their employer. As a reward, they get raises.

The problem is, those raises are often based on meeting minimum standards for specified periods of time-not the value an employee brings to the table.

As a result, when push comes to shove and a company needs to evaluate the worth of an employee, “years on the job” means far less to the business than added value.

TIME EQUALS MONEY … RIGHT?

Many employees are confused about what their salaries pay for. When people first enter the workforce as teenagers, they usually start with an hourly wage. The equation is simple: The more you work, the more money you get.

Unfortunately, after a couple of years, many people begin to translate time into money and begin to think, “I’ve put in a lot of time at this job, so it stands to reason that I should be making a lot of money! I need a raise!”

Unfortunately, after a couple of years, many people begin to translate time into money and begin to think, “I’ve put in a lot of time at this job, so it stands to reason that I should be making a lot of money! I need a raise!”

Allow this bubble to burst. Value isn’t a function of time. There are 24 hours in a day whether a company pays for them or not-it’s what you do with those hours that counts.

Even for hourly employees, businesses aren’t paying for time-they’re paying for value. To put it simply, an employee is a company asset, and compensation is an investment in that asset.

If you’re having difficulties in getting the return from your business that your companies need, there are organizations that can help. We do it every day.

Revitalization Partners is a Northwest business advisory and restructuring management firm with a demonstrated track record of achieving the best possible outcomes for our clients. And now, we’ve written a book to help our readers understand the issues facing their businesses. You can find this compilation of our business thoughts at:

https://revitalizationpartners.com/we-could-write-a-book/ or on Amazon.

We specialize in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations.

Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.