There is growing evidence of a soon-to-be reported spike in the number of non-performing loans in lender portfolios, and time is running out to take the difficult but necessary measures to mitigate their risk.

There is growing evidence of a soon-to-be reported spike in the number of non-performing loans in lender portfolios, and time is running out to take the difficult but necessary measures to mitigate their risk.

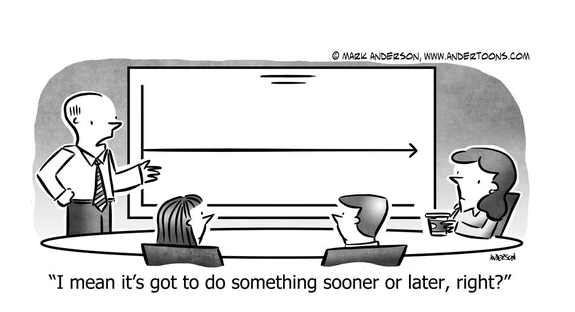

The question isn’t whether or not that intervention will or won’t be required, it’s when it will be.

Since the beginning of the COVID-19 crisis, the Federal Reserve has taken swift action to provide a number of tools to help banks cope with this anticipated increase in non-performing loans.

DEFERRED PAYMENT PROGRAMS …

One of the most sweeping programs, which was aimed at helping small- to medium-sized businesses early in the COVID crisis, was the deferred payment program. If borrowers could not make monthly loan payments, lenders were allowed to initially defer those obligations for a three-month period. The deferral period ultimately could be extended to six months or longer based on the lender’s discretion.

One of the most sweeping programs, which was aimed at helping small- to medium-sized businesses early in the COVID crisis, was the deferred payment program. If borrowers could not make monthly loan payments, lenders were allowed to initially defer those obligations for a three-month period. The deferral period ultimately could be extended to six months or longer based on the lender’s discretion.

While the program was responsible for saving thousands of businesses in the short term, its continuation has created significantly increased exposure for participating lenders. According to an American Banker article from August, as borrowers struggled with the effects of the first few months of the COVID-19 pandemic, the amount of deferred loans at Bank of America, Citigroup, JPMorgan Chase and Wells Fargo exceeded $150 million.

RELIEF PROGRAMS NOT ENOUGH …

Further, the same banks set aside more than $32 billion for loan losses in the second quarter of this year, which indicates they have a high degree of uncertainty about the length of the pandemic and the resulting economic crisis.

Further, the same banks set aside more than $32 billion for loan losses in the second quarter of this year, which indicates they have a high degree of uncertainty about the length of the pandemic and the resulting economic crisis.

The towering number of deferred loan payments, combined with the near record level of increased loan loss reserves in a single quarter, signal that relief programs may not be enough to deal with the tsunami that is forming.

Domestic banks’ concerns over the threat was initially revealed in a survey taken in May by the Federal Reserve Bank of Dallas.

Findings showed that 83% of financial institutions expected an increase in non-performing loans within six months while 27% reported an increase in non-performing loans during the preceding six weeks.

Data from their recent November 2020 survey confirmed those threats by reporting an alarming increase in current and future nonperforming loans.

THESE COLLECTIVE FEARS …

The continued concern related to the projected increase in nonperforming loans is based in part on a heightened sense of uncertainty around the political landscape, the second wave of COVID-19 outbreaks and economic downturn, and federal spending.

These collective fears are heightened by the number of businesses that may not have the financial or operational expertise to rapidly respond to swift declines in revenue.

These collective fears are heightened by the number of businesses that may not have the financial or operational expertise to rapidly respond to swift declines in revenue.

While many companies have taken immediate steps to downsize their business and generate positive cash flow, there are also many operators, particularly in the lower middle market, that do not have the management skills or experience in dealing with dramatic business downturns.

COMMERCIAL LENDERS SHOULD BE …

Because of the magnitude of troubled credits, commercial lenders should be extra vigilant and not wait for loan deferral programs to end before taking action to mitigate loan write-downs. All lenders have tools to continually evaluate and score the creditworthiness of their commercial borrowers.

However, there is a risk that the usual warning signs raised by these methods will be somewhat neutralized or minimized by the availability of the current loan deferral programs.

While actions may be taken to exit or foreclose on the worst of the worst loans in a lender’s deferred payment program, this represents a small fraction of the loans.

The majority of businesses in the portfolio, however, will likely continue to operate, and if appropriate action to mitigate cash flow losses is not taken, they will reach a point of no return.

At that juncture, they will never be able to repay the loan in full and the lender will be faced with writing off a portion – if not the entire loan – as a loss.

QUARTERLY FINANCIAL REPORTING …

Most commercial credit loans require at least quarterly financial statement reporting along with covenant testing.

As a condition to approve a deferred loan, lenders should require increased financial reporting, including monthly profit and loss and balance sheet, 13- week cash flow projections in addition to monthly documentation describing where a business stands against cash flow forecasts.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.