The pullback in total lending in the last half of March was broad and included fewer real estate loans, as well as fewer commercial and industrial loans.

The pullback in total lending in the last half of March was broad and included fewer real estate loans, as well as fewer commercial and industrial loans.

Furthermore, the American Bankers Association index of credit conditions fell to the lowest level since the onset of the pandemic, indicating bank economists see credit conditions weakening over the next six months.

As a result, banks are likely to become more cautious about extending credit.

ALTERNATIVE LENDERS …

These issues will most likely result in a significant number of borrowers needing to look for new lenders.

Borrowers that cannot obtain credit facilities from traditional lenders will be searching for viable alternatives such as bank and non-bank asset-based lenders that are in a better position to handle their credit requirements.

Borrowers that cannot obtain credit facilities from traditional lenders will be searching for viable alternatives such as bank and non-bank asset-based lenders that are in a better position to handle their credit requirements.

This opportunity is further supported by a fourth-quarter 2022 survey of bank and non-bank ABL lenders by the firm Secured Finance Network (SFNet), which focused on key indicators for its quarterly Asset-Based Lending Index and SFNet Confidence Index.

STEADY CONFIDENCE …

The survey showed steady confidence in the asset-based lending market and asset-based lenders maintained a positive outlook despite persistent inflation and rising interest rates.

“As the U.S. economy remains under stress, the asset-based lending industry is primed to meet new demand,” said SFNet CEO Richard D. Gumbrecht. He continued: “Commitments have increased, and portfolio performance remains solid. Should we see a recession, the ABL industry stands ready to provide vital working capital.”

The SFNet survey also revealed some interesting comparisons of bank and non-bank asset-based lenders.

The SFNet survey also revealed some interesting comparisons of bank and non-bank asset-based lenders.

For banks, asset-based loan commitments (total committed credit lines) were up 2.4% in the fourth quarter compared to the previous quarter.

However, their outstandings (total asset-based loans outstanding) for the same time period fell by 1.6%.

Lower new commitments and higher commitment runoff reduced net commitments in Q4, the second consecutive quarter of decline.

NON-BANK ABL LENDERS HAVE …

Non-bank ABL lenders, however, saw total commitments rise by 6% last quarter. Total outstandings were up, as well, by 1.7%. Compared to the same quarter last year, total commitments and outstandings for non-banks rose by 10.4% and 18.6% respectively.

The SFNet report stated: “Further, a large majority of non-banks reported increased new commitments in Q4, which grew by 277% from Q3” which is an indicator that non-bank lenders have a significant advantage in expanding their loan portfolios.

This substantial increase in non-bank asset-based lender commitments reflects the reality that they have an edge in attracting new borrowers as they do not have to face the same regulations that bank-based asset-based lenders are bound by.

This substantial increase in non-bank asset-based lender commitments reflects the reality that they have an edge in attracting new borrowers as they do not have to face the same regulations that bank-based asset-based lenders are bound by.

They are allowed to take more risks in lending by increasing advance rates on traditional assets such as accounts receivable and inventory, as well as expanding the collateral pool to non-traditional ABL assets such as trademarks, real estate and a broad range of equipment.

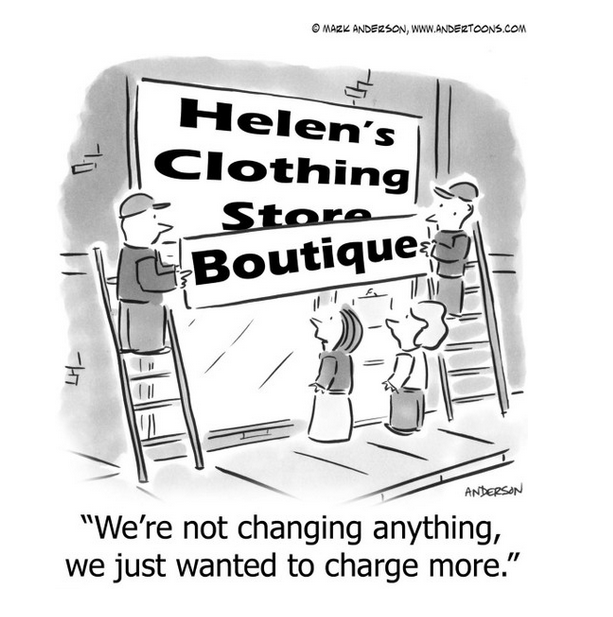

IT COMES AT A PRICE …

Utilizing non-bank ABLs offers an opportunity for businesses to increase their borrowing capacity, a necessity for increased liquidity to operate a business.

Utilizing non-bank ABLs offers an opportunity for businesses to increase their borrowing capacity, a necessity for increased liquidity to operate a business.

However, it comes with a price, as they also have substantially increased costs related to higher interest rates, collateral monitoring fees and other related expenses.

There are a wide range of options for small to medium-sized business borrowers to consider when looking for an asset-based lender and it’s important to make sure that they consider a lender that is best for their business.

It’s also important to negotiate a lending arrangement that is for an appropriate length of time, to allow for management to implement a game plan to improve their business as rapidly as possible.

This will enable the business to become “bankable” again with a traditional commercial bank lender to reduce their overall borrowing costs.

NOTHING LASTS FOREVER …

While the time is right for asset-based lenders to substantially increase their loan portfolios, the economy will eventually improve, and businesses’ performance will recover to pre-pandemic levels as well.

While the time is right for asset-based lenders to substantially increase their loan portfolios, the economy will eventually improve, and businesses’ performance will recover to pre-pandemic levels as well.

Asset-based lenders should prepare for this and offer options that will substantially lower the borrower’s costs when this economic shift occurs, in an effort to retain the businesses for the long run.

And, if companies need help in navigating the asset-based lender landscape, don’t be afraid to ask.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.