Recently Revitalization Partners was contacted by a company that needed help with their commercial loan.

Recently Revitalization Partners was contacted by a company that needed help with their commercial loan.

The lender had, in addition to the original loan, issued three forbearance agreements, none of which the borrower had been able to comply with.

At that point, the latest forbearance agreement required that the borrower bring in a Chief Restructuring Officer to assume responsibility for the operation and financial performance of the company.

While this borrower was having problems with the lender, it is fair to say that the lender was also having problems.

PERSONAL & FAMILY ACTIVITIES …

Like many owners of small businesses, the borrower tended to use the business as a piggy bank.

Like many owners of small businesses, the borrower tended to use the business as a piggy bank.

In addition to the normal business activities, a significant amount of money came out of the company for personal and family activities. To avoid income tax, this money was carried on the books as a loan to the borrower. By the time it reached almost a million dollars, it was clear that the funds were never going to be paid back.

By the time this loan reached the third forbearance agreement, there were some very unusual covenants associated with the agreement and loan.

By the time this loan reached the third forbearance agreement, there were some very unusual covenants associated with the agreement and loan.

The lender required that the company maintained a “joint account” with the lender. All funds were supposed to go into the account and the lender would approve checks. Therefore, the borrower ended up writing several bad checks as he was never sure which checks would get approved.

$ 250K EXIT FEE …

While the lender wanted to get out of this relationship, the cost to the borrower had escalated to a $250,000 “exit fee” in addition to paying off the original loan with interest due.

While the lender wanted to get out of this relationship, the cost to the borrower had escalated to a $250,000 “exit fee” in addition to paying off the original loan with interest due.

In desperation, the borrower had opened a new account into which he deposited funds to pay for items that the original lender would not approve.

As this was a violation of both the loan document and all the forbearance agreements, the borrower was in violation the second he signed the new agreement.

Neither side trusted the other at all.

How did we get here?

It began with a successful entrepreneur who ran a unique business for a number of years.

Then, due to a new product launch that went awry , he had a bad year and got into trouble with his bank.

The bank wanted him out, but given the short-term track record, he didn’t know where to turn.

A FRIEND OF THE FAMILY INVESTOR …

Then, a friend of the family “investor” offered to purchase a reasonable percentage of the company for enough money to settle with the bank.

Then, a friend of the family “investor” offered to purchase a reasonable percentage of the company for enough money to settle with the bank.

And since it would be equity, it would not have to be paid back.

While the “equity documents” were being drawn up and the borrower was negotiating with the investor, the investor suggested that, since the borrower needed the funds NOW, they just draw up a convertible note to move forward.

The borrower received his money, he made use of it and all was fine until the “investor” changed his mind and wanted his funds back.

The borrower received his money, he made use of it and all was fine until the “investor” changed his mind and wanted his funds back.

The borrower didn’t have them and after some unpleasantness, the investor went to court and got a judgment against the borrower.

AND NOW A LOAN BROKER …

At the same time, the borrower had turned to a loan broker that he found on the East coast.

At the same time, the borrower had turned to a loan broker that he found on the East coast.

While a loan broker is supposed to distribute your application to several different lenders and to educate you about the pluses and minuses different lenders and loans, this broker found only one, the lender with which the borrower was having so many problems.

The broker charged a reasonable fee of 5%, although the agreement did not specify if he received any further fees from the lender.

The agreement was supposed to remain in place for only two months, however it renewed automatically if not cancelled and by the time in 2018 that all of this occurred, had been in place for about 3.5 years.

PROUDLY NEVER USED AN ATTORNEY ???

The other factor related to how we got here is the fact that the borrower had, over the life of his business, had never used an attorney. And he was proud of that fact, having negotiated and signed every document himself.

The other factor related to how we got here is the fact that the borrower had, over the life of his business, had never used an attorney. And he was proud of that fact, having negotiated and signed every document himself.

As a result, the loan documents, the “investor” agreements, etc. were all the product of his own knowledge.

At the time Revitalization Partners became involved, he had the lender insisting he execute the current forbearance agreement and refusing to authorize the retainer unless it got signed, while at the same time insisting that he get help.

There was already a judgment against him and two others ready to be filed. He had executed multiple personal guarantees and a stock pledge of the company’s equity.

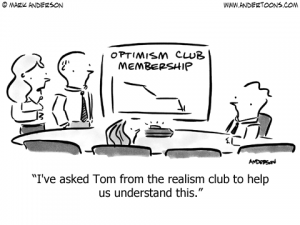

AND A LACK OF REALISM …

Given the situation, we strongly suggested that he entered a receivership as the company had significant value when protected by the court.

Given the situation, we strongly suggested that he entered a receivership as the company had significant value when protected by the court.

He resisted as he believed that a Chapter 11 would allow him to end up keeping his company although he had no ability to fund debtor in possession, no ability to get a bankruptcy plan approved and would have to manage a personal insolvency simultaneously.

Given what we viewed as a lack of realism related to the situation, we declined to go forward.

No one, no matter how talented, can know everything.

No one, no matter how talented, can know everything.

And financing is one of those areas where experience and knowing the lenders counts.

For example, Revitalization Partners has successfully helped 100% of the companies we have agreed to work with to get new loans.

And to avoid any conflict of interest, we do not accept a commission from either the lender or the borrower for that service.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.