The easiest way to spark a financial crisis and wreck the US economy would be to allow the federal government to default on its debt.

The easiest way to spark a financial crisis and wreck the US economy would be to allow the federal government to default on its debt.

It would be an epic, unforced error and millions of Americans would pay the price.

And yet that unlikely situation is once again being contemplated. If Congress doesn’t raise the limit on federal borrowing the federal government will most likely run out of cash and extraordinary measures in October the Treasury Secretary warned lawmakers.

In short, a default would be an economic cataclysm. Interest rates would spike, the stock market would crater, retirement accounts would take a beating, the value of the US dollar would erode, and the financial reputation of the world’s only superpower would be tarnished.

A FINANCIAL ARMAGEDDONDON …

“It would be financial Armageddon,” Mark Zandi, chief economist at Moody’s Analytics, told CNN. “It’s complete craziness to even contemplate the idea of not paying our debt on time.”

“It would be financial Armageddon,” Mark Zandi, chief economist at Moody’s Analytics, told CNN. “It’s complete craziness to even contemplate the idea of not paying our debt on time.”

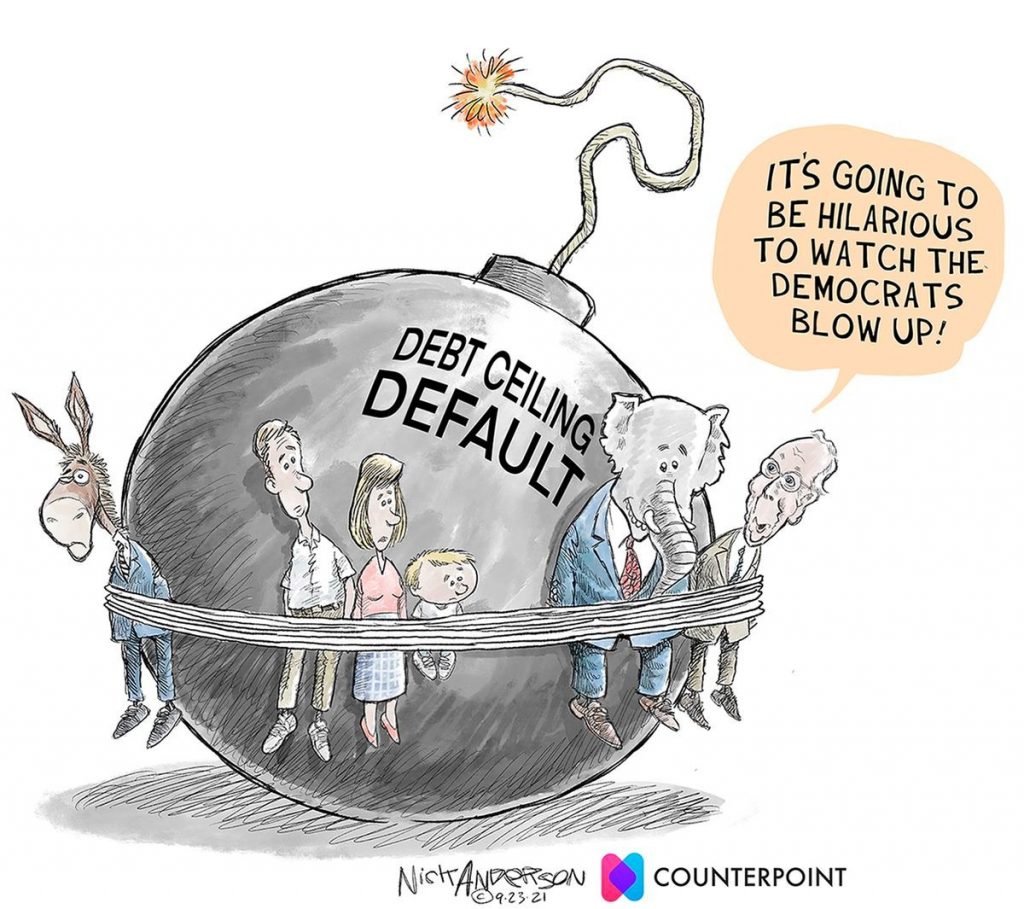

Lawmakers in Washington are again playing chicken with America’s creditworthiness. And the path to raising the debt ceiling is not clear.

Even though Congress has in the past raised the debt ceiling with a bipartisan vote, Senate Minority Leader Mitch McConnell vowed in July that Republicans will not vote to raise the debt ceiling.

Lest you believe that this is about money, it’s not.

McConnell has stated that he doesn’t want to fund the Democratic large spending proposals. That may be true, but it has nothing to do with the debt ceiling. The debt ceiling is to allow the United States to pay the bills for money already spent.

The Democrats claim that since most of the money was spent during the Trump years, the Republicans should help pay the bill. That is only partially true as anyone who bought a bond with a due date longer than five years was owed money prior to the Trump administration.

DAMAGE AMERICA FOR 100 YEARS …

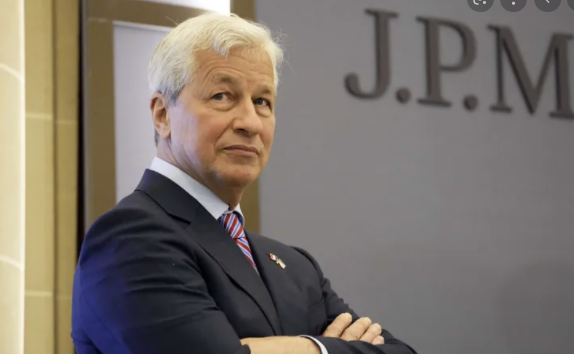

JPMorgan Chase (JPM) CEO Jamie Dimon urged lawmakers not to even think about going down this path.

JPMorgan Chase (JPM) CEO Jamie Dimon urged lawmakers not to even think about going down this path.

During a hearing in May, Dimon said an actual default “could cause an immediate, literally cascading catastrophe of unbelievable proportions and damage America for 100 years.”

The Treasury Secretary stated that history shows that waiting “until the last minute” to suspend or increase the debt limit “can cause serious harm” to business and consumer confidence, raise borrowing costs for taxpayers and hurt America’s credit rating. “A delay that calls into question the federal government’s ability to meet all its obligations would likely cause irreparable damage to the U.S. economy and global financial markets.”

A US default would undermine the bedrock of the modern global financial system. “We pay our debt. That’s what distinguishes the United States from almost every other country on the planet,” Zandi of Moody’s said.

Because of America’s long track record of paying its debt, it’s very cheap for Washington to borrow.

HIGHER BORROWING COSTS …

But a default would force ratings companies to downgrade US debt and shatter that borrowing advantage.

But a default would force ratings companies to downgrade US debt and shatter that borrowing advantage.

Higher borrowing costs would make it much harder for Washington to borrow to pay for infrastructure, the climate crisis or to fight future recessions.

And refinancing America’s nearly $29 trillion mountain of existing debt would become that much more expensive. Interest expenses, which totaled $345 billion in fiscal 2020, would quickly rival what Washington spends on defense.

Soaring Treasury rates would set off a chain reaction in financial markets. That’s because Treasuries, viewed as risk-free investments backed by the full faith and credit of the federal government, serve as the benchmark by which virtually all other securities are measured.

A KEY BENCHMARK …

Not only would millions of Americans lose money in the stock market, but it would suddenly become more expensive for families and companies to borrow.

Not only would millions of Americans lose money in the stock market, but it would suddenly become more expensive for families and companies to borrow.

That’s because Treasuries serve as the benchmark for mortgages, car loans, credit cards and corporate debt. A spike in borrowing costs is a huge problem for an economy that relies on access to credit.

If the debt ceiling is not lifted, then the federal government will technically default on some of its obligations. It would be forced to prioritize payments, deciding who will get paid and who won’t.

Ultimately, someone will lose out, whether it’s federal employees, veterans, Social Security recipients, defense contractors or small business with government debt.

PLAYING POLITICS …

“Playing politics with the debt ceiling is always a bad idea,” said Isaac Boltansky, director of policy research at Compass Point Research & Trading, “but it is a uniquely childish notion given where we are with the virus and the economic recovery.”

In other words, a debt ceiling crisis, let alone an actual default, is the last thing the recovering economy needs right now. Especially when small businesses are facing the future without new government funding.

And, if a government shutdown occurs and those existing loans cannot be forgiven in a timely manner, even those businesses that would qualify for new debt would either have to wait until those loans are resolved or, at best, pay interest rates that reflect the increased risk to the new lenders.

This could accelerate and increase the depth of projected bankruptcies and receiverships.

Maybe it’s time to tell our politicians that if they want to play childish games, it’s time to go home and play them in their own backyards.

We shouldn’t elect children to represent us.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.