It’s not unusual to see headlines that highlight companies that are in trouble or in some form of distress.

It’s not unusual to see headlines that highlight companies that are in trouble or in some form of distress.

They may range from companies that have had multiple layoffs, those that are having significant financial difficulties, or are filing bankruptcy for the first, or sometimes even the second time.

In a number of situations, companies encounter issues that are unexpected or happen so fast that the CEO cannot react quickly enough to correct the problem.

However, in many cases, the problems or circumstances that arise could have been anticipated or could have been corrected before the company suffered significant financial damage.

IN TROUBLE FOR MANY REASONS …

CEOs may find themselves in trouble for many reasons, however there are numerous examples of those that are able to successfully overcome the obstacles, learn from their experience, and get back on a solid financial footing.

CEOs may find themselves in trouble for many reasons, however there are numerous examples of those that are able to successfully overcome the obstacles, learn from their experience, and get back on a solid financial footing.

On the other hand, there are also CEOs that don’t have the ability to recognize and correct operational problems that could have been resolved in a timely manner. The inability to predict and react in a timely fashion impacts a number of constituents that depend on the CEO to do their job.

These include the company’s lenders, employees, shareholders, vendors and the board of directors. The ramifications have far reaching financial consequences to these groups. So, the key question that most people will ask, usually after the fact, is why did this happen and how could the CEO have proactively mitigated the issues to minimize the financial impact and consequences to others.

ANALYSIS – PARALYSIS MODE …

In our practice, we have encountered many situations where a company’s CEO either did not anticipate an operational problem that had devastating consequences on the health of the business, or literally did not have the capability to foresee the problem and/or develop a plan to mitigate it.

We find that troubled companies’ CEOS typically have one or more similar traits that prevent them from proactively addressing the problem. One common trait is Analysis – Paralysis, or over-analysis, continuing to analyze numbers for extended periods of time, hoping to find a different answer.

We find that troubled companies’ CEOS typically have one or more similar traits that prevent them from proactively addressing the problem. One common trait is Analysis – Paralysis, or over-analysis, continuing to analyze numbers for extended periods of time, hoping to find a different answer.

The CEO will ask for detailed analyses that they hope will lead them to a solution. If they don’t find an answer immediately, they will continue to ask for more analysis until it’s too late to change tactics or strategy to overcome the problems.

These type of CEOs are typically data driven first and fail to dig into the operational issues to find the source of the problem that resulted in the company’s financial decline.

FOUNDER – CEO SYNDROME …

We also have encountered founder or inventor CEO types that have started a business with a great idea and have managed it through the early stages.

They often have early success in growing the business, however there is a point that the size, complexity and rate of growth exceeds the CEO’s level of experience or competence to cope with the challenges that are encountered.

They often have early success in growing the business, however there is a point that the size, complexity and rate of growth exceeds the CEO’s level of experience or competence to cope with the challenges that are encountered.

Instead of acknowledging their own limitations, the CEO continues to attempt to manage the company the same way they have done in the past, and the business suffers as a result.

The inability to foresee this and bring in experienced executives to help them anticipate these challenges, or in fact to find an experienced CEO to lead the company and step out of the way, typically results in disastrous consequences.

ADVICE NOT NEEDED …

A CEO that is full of confidence is usually a good trait. However, when that level of confidence results in a CEO only believing in what he thinks and not being open to the opinions or thoughts of others, businesses often incur significant operating problems.

This type of behavior may not be prevalent at the beginning, however as the CEO gains more experience in the job, they come to believe they don’t need to listen to subordinates, or even worse, do not need to listen to advice of the board of directors and outside advisors.

The consequence of this behavior sets up a scenario where the CEO is operating in a world of their own and will likely not see the warning signs that the business may be on a downward spiral and act to make the changes required to turn it around.

PROBLEM WILL SELF-CORRECT …

There are also CEOs that we like to characterize as “putting it off for a rainy day.” This type of behavior is typically driven by lack of experience or confidence to proactively manage their business.

There are also CEOs that we like to characterize as “putting it off for a rainy day.” This type of behavior is typically driven by lack of experience or confidence to proactively manage their business.

When an operating problem occurs, such as a decline in revenue or an excessive increase in expenses, they take the attitude that the problem will correct itself and get better without making significant changes.

Often the problem goes on for many months, however the CEO feels that by waiting one more month the business will improve. Improvements usually do not happen without some type of intervention and as a result the business suffers, or worse completely fails. As we often say, “Hope is not a Strategy”!

CHECKS & BALANCES …

Many businesses have checks and balances to monitor their CEO’s performance and are able to recommend alternative tactics or strategies when these types of behaviors are identified.

The first line of defense is the company’s board of directors, and it’s important for them to identify this type of behavior early in the cycle.

The first line of defense is the company’s board of directors, and it’s important for them to identify this type of behavior early in the cycle.

Lenders can also be an important check on a CEO’s actions. Making sure they closely monitor the financial performance of companies in their portfolio on a quarterly basis is an important step.

Having regular conversations with the CEO about the business and its underlying drivers, as well as how the company is performing against projections, can also be important in understanding if the CEO can adequately explain the financial variances and has a plan to get the business back on track.

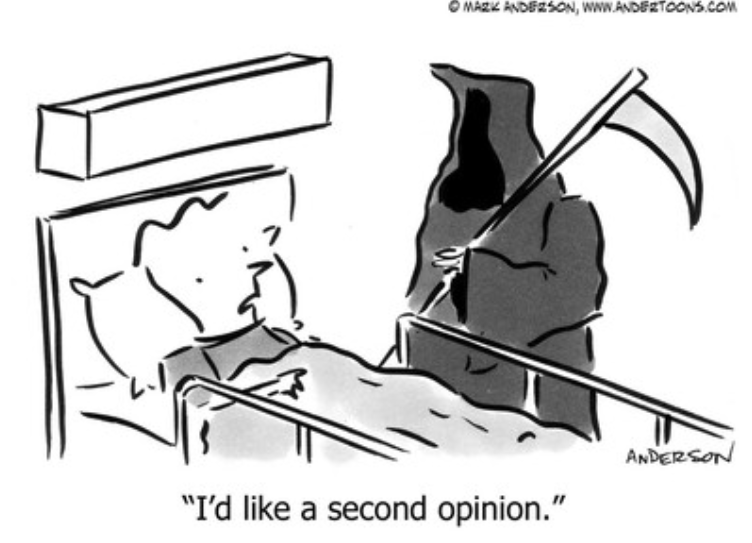

GET A 2nd OPINION …

Many of the traits that have been discussed can be rectified by coaching the CEO or outright replacing them if the operating problems are not being dealt with.

Many of the traits that have been discussed can be rectified by coaching the CEO or outright replacing them if the operating problems are not being dealt with.

For a board member, or constituent depend on the company’s performance, understanding the psychology traits of a CEO is extremely important in order to help them deal with the potential consequences of their lack of action.

It is also important to ask for advice from an advisor with experience in dealing with this type of personality, to get a second opinion before it’s too late.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.