Given the current business climate, particularly in light of recent negative economic indicators, there is little question that more businesses will be showing signs of distress.

For example, the US business activity gauge contracted for the third consecutive month, according to an S&P index, as a result of high inflation and increasing interest rates.

Loan default rates have also more than doubled since the beginning of the year. Furthermore, US bankruptcies are forecasted to increase over 50% by the second quarter of 2023 compared to the prior year according to Trading Economics.

NO COMPANY IS IMMUNE …

It’s unsurprising then, based on the above data, that many businesses have been unable to cope with the rapid increase in inflation, rising interest rates and a slowdown in demand for their services or products.

It’s unsurprising then, based on the above data, that many businesses have been unable to cope with the rapid increase in inflation, rising interest rates and a slowdown in demand for their services or products.

No company is immune from these factors and their ability to cope with such challenges is typically hampered by management’s inability to deal with them in a timely fashion.

This inaction ultimately results in a rapid decline in revenue and cash flow and frequently leads to the business becoming insolvent.

ONLY A FEW CHOICES …

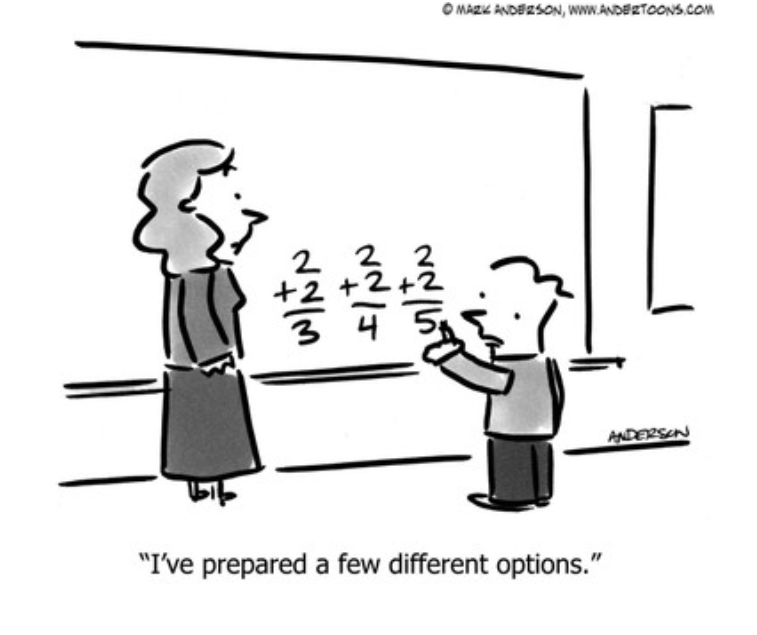

When businesses become insolvent, they have only a few choices to deal with the problem. The most frequent thing we hear in these circumstances is that “we will just file for bankruptcy and reorganize the business”.

When businesses become insolvent, they have only a few choices to deal with the problem. The most frequent thing we hear in these circumstances is that “we will just file for bankruptcy and reorganize the business”.

Once management has contacted an insolvency attorney, they often find this option is either not a viable solution due to the lack of resources to pay professional fees, and/or they don’t have a realistic plan to generate enough cash to pay back their creditors.

The State of Washington laws provide for an alternative by way of a court-ordered “Receivership” or an “Assignment for the Benefit of Creditors”. In this situation, a neutral third-party professional steps into the shoes of a business-owner and manages the process in a way that maximizes the value of the assets for the benefit of its creditors.

The “receiver” is considered to be an officer of the court and manages the process based on the powers they receive as outlined in the Washington State Receivership Act.

A BETTER ALTERNATIVE …

There is typically a belief that the receiver’s job is to rapidly wind down the business and sell the company’s physical assets at an auction. While this is a possible solution in some situations, it does not always provide the best return for the creditors or for the stakeholders.

There is typically a belief that the receiver’s job is to rapidly wind down the business and sell the company’s physical assets at an auction. While this is a possible solution in some situations, it does not always provide the best return for the creditors or for the stakeholders.

There is usually a better alternative, where the receiver operates the business as a going concern and eventually sells the assets of an operating business to the highest bidder.

As part of this process, the receiver rapidly streamlines the business and optimizes cash flow, with the goal of generating enough free cash flow to pay all expenses including the expense of the receivership.

In many situations, the amount of cash generated can exceed the expenses and as a result the receiver actually improves the value of the estate by increasing cash balances.

ANOTHER SIGNIFICANT BENEFIT …

Another significant benefit of operating the company in a receivership, is to leverage the receivership statutes in a way that enables the receiver to collect cash that might not have been collectable otherwise.

Another significant benefit of operating the company in a receivership, is to leverage the receivership statutes in a way that enables the receiver to collect cash that might not have been collectable otherwise.

For example, the receiver can compel collection of past due accounts receivable or payments on construction contracts, regardless of outstanding liens or other encumbrances.

The receiver has the support of the receivership statutes, their legal representatives and the court to compel these payments, when otherwise these amounts might not have been collected. These actions also increase the value of the estate by adding to the cash balances

A GOING CONCERN VALUE …

Selling the business as a going concern benefits the receivership estate by generating more cash than would be achieved by outright liquidating the assets of the business.

Selling the business as a going concern benefits the receivership estate by generating more cash than would be achieved by outright liquidating the assets of the business.

In these situations, the assets are valued based on their use to the individual buyers, as a package that generates ongoing cash and therefore has more value.

One additional benefit is that employees of the company are retained by the receiver and typically end up being employed by the company that purchases the assets subsequent to the sale of the business.

Another benefit is that the creditors of the business typically continue to supply goods and services to the receiver and often continue to sell to the company’s new owners.

OVER 30 CASES …

Since 2009, Revitalization Partners has served as a receiver in over 30 cases in Washington and Oregon.

During those proceedings, we have typically sold assets of the company as a going concern and have significantly maximized the value of those assets at a value in excess of what would have resulted from a liquidation of the assets of a non-operating company.

During those proceedings, we have typically sold assets of the company as a going concern and have significantly maximized the value of those assets at a value in excess of what would have resulted from a liquidation of the assets of a non-operating company.

We have also gained valuable experience in managing the affairs of the estate in a way that increases the value to the creditors and stakeholders.

When companies, lenders and attorneys look at options to deal with insolvent companies, it is important to look at all potential possibilities.

When considering receivership as an option, make sure to talk to professionals who have the experience in maximizing the value of assets for all stakeholders.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.