We have worked with a number of family-owned businesses over the past twenty years and have learned that they have many unique qualities.

We have worked with a number of family-owned businesses over the past twenty years and have learned that they have many unique qualities.

A recent study completed by McKinsey and Company supports that finding and, in fact, has found that family-owned businesses outperform businesses that are not family-owned.

McKinsey analyzed 600 publicly listed family-owned businesses and compared their performance with 600 publicly listed companies that are not family-owned around the world.

They also surveyed an additional 600 primarily private family-owned businesses as well as interviewing leaders of family-owned businesses.

A SIGNIFICANT IMPACT …

Family-owned businesses (FOB) have a significant impact on the global economy as well as on the United States economy.

Family-owned businesses (FOB) have a significant impact on the global economy as well as on the United States economy.

In fact, the McKinsey study found that family businesses account for more than 50% of the global GDP and for nearly 60% of private employment in the United States.

This finding, taken in conjunction with the fact that family businesses were also found to outperform nonfamily businesses, demonstrates just how significant their impact is on the economy, both globally and in the United States.

It’s important for all businesses to understand what attributes set family businesses apart from other businesses, and what lessons they can learn from McKinsey’s research.

SUPERIOR OPERATIONAL PERFORMANCE …

McKinsey found that one important factor in FOB’s performance is their superior underlying operational performance.

This is an important attribute that drives improved bottom-line performance and is supported by several factors.

Those factors include four distinctive mindsets in the highest performing family businesses.

For example, the four mindsets include:

For example, the four mindsets include:

- a focus on purpose beyond the bottom line;

- greater reinvesting of capital (a sign of longer-term orientation)

- a conservative financial record (with lower average debt ratios)

- and centralized, efficient decision-making.

SEVERAL DISTINCT IMPERATIVES …

In addition, McKinsey found that outperforming FOBs also have several distinct imperatives:

1. They excel in operations and investing. In general, successful young FOBs do well because of efficient capital deployment. As they age and grow, operational efficiency becomes more important.

As a result, their operating margins are much better (17.7% vs. 9.4%). There are three major reasons for this record: a hands-on management approach, stronger performance management and greater investment.

2. They obsess over talent. FOBs believe they manage it well: 86% of outperformers said their company attracts the best talent, and more than 90% said they are good at developing it.

This doesn’t just happen. Leaders take clear action, such as benchmarking compensation against the competition and offering effective training programs to prepare the next generation.

3. They ensure strong governance. The most important factors driving this attribute are: 80% had written guidelines on the roles and responsibilities of family members; 90% had an independent board of directors (compared with 72% for the rest), and 95% involved non-family executives in strategy decisions.

Multigenerational FOBs tend to have a merit-based approach to managing the business.

They know that their long-term success requires focusing on the survival of the business, and if that means loosening the reins of family stewardship, so be it.

FACE UNIQUE CHALLENGES …

While the survey reveals a mindset and imperatives that contribute to their above average performance, family businesses, practically speaking, also face unique challenges that must be overcome.

We have helped many family businesses and have found that there are sometimes personal and emotional factors that some members of management bring into the business.

We have helped many family businesses and have found that there are sometimes personal and emotional factors that some members of management bring into the business.

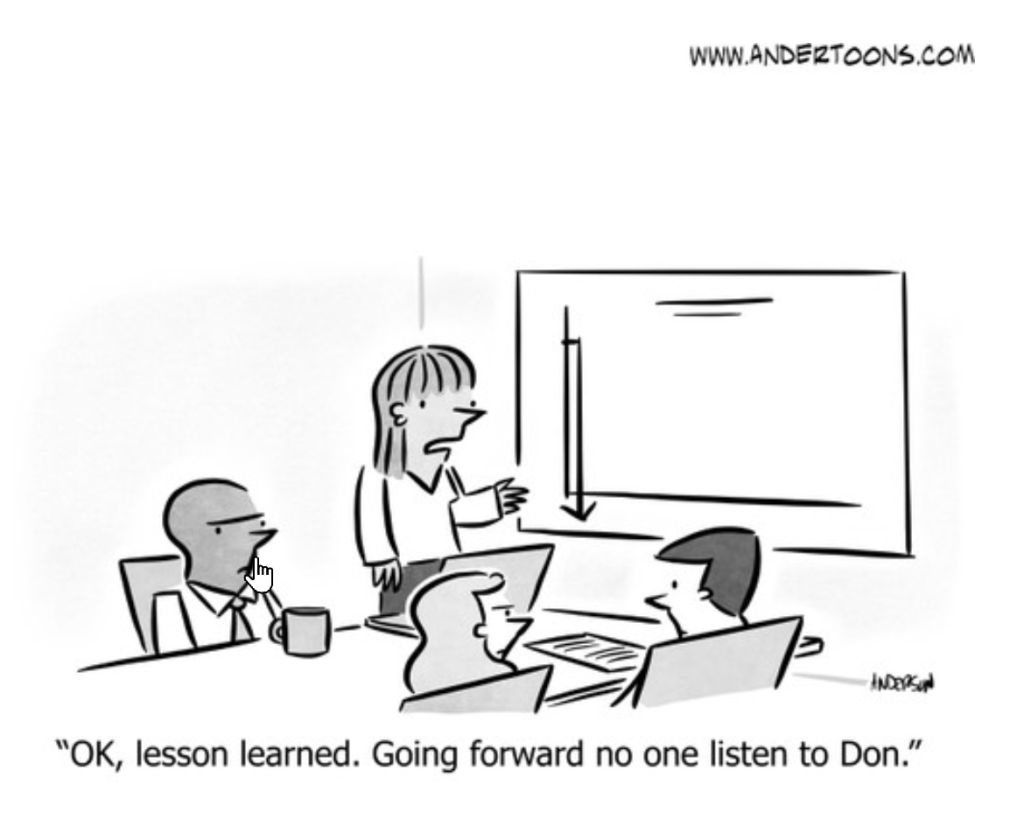

Bringing personal biases or family feuds into a business could, in our experience, negatively impact the effectiveness of the management team and result in poor operating performance.

We have also found that family members that have strong or overbearing personalities often shift the power dynamics and the related decision-making, from what is best for the company to what is best for the individuals that have the loudest voices.

Addressing these issues early on is important to mitigate the potential negative consequences.

NO EASY FEAT …

Managing a family business with above average performance is no easy feat, and FOBs must constantly be striving to excel.

There are also other variables that could impact even the best performing FOBs that are somewhat out of their control.

For example, making a generational change in leadership may impact the governance of the business and adjustments may be necessary.

FOBs may also find themselves in an industry that is stagnant or vulnerable to competition and as a result strategic shifts may be necessary. In all cases, sound judgment and adaptability to circumstances are essential.

It’s important that all businesses learn lessons from the positive attributes of family businesses.

And they also can draw on the experience of outside advisors in helping them resolve these issues in a timelier manner.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.