A recent third quarter survey conducted by Phoenix Management reveals lenders are increasingly pessimistic of the US economy in both the near term and long term.

A recent third quarter survey conducted by Phoenix Management reveals lenders are increasingly pessimistic of the US economy in both the near term and long term.

This is a change from the same survey in the second quarter where lenders felt that economic performance expectations increased for the near term.

IN A RECENT SURVEY …

In order to better understand why there has been a negative shift in lenders attitude, we highlighted excepts from the survey to gain a better understanding of their views:

> Lenders optimism on the U.S. economy decreased 14% in Q3 compared to Q2 2019

> Lenders optimism on the U.S. economy decreased 14% in Q3 compared to Q2 2019

> The majority of lenders believe borrowers will be moderately affected by the current trade war with China and expect a slight increase in borrower costs as a result

> In Q3 2019, lenders’ optimism increased in large corporate (4%) and middle market (9%), however, expectations for small business saw a significant decrease (-26%)

> In Q3 2019, lenders’ optimism increased in large corporate (4%) and middle market (9%), however, expectations for small business saw a significant decrease (-26%)

> The majority of lenders agree that consumer behavior will be key to a continued strong economy. Survey respondents expressed some concern regarding consumer growth and in fact expect some moderation from the previous survey. While moderation is not a negative factor, it is a change from the stronger consumer growth trend the US has experienced in past quarters

> A significant percentage of lenders surveyed expressed concern with the following industries that are expected to experience the most volatility and increasing risk: Retail Trade, Manufacturing, Healthcare, Construction and Transportation and Warehousing

> A significant percentage of lenders surveyed expressed concern with the following industries that are expected to experience the most volatility and increasing risk: Retail Trade, Manufacturing, Healthcare, Construction and Transportation and Warehousing

THROUGH THEIR OWN LENS …

It is important to understand that lenders view the economy through their own lens, which primarily focuses on risk. Their view influences decisions related to credit risks, new clients and companies they perceive as high risk that could default on their loans.

It is important to understand that lenders view the economy through their own lens, which primarily focuses on risk. Their view influences decisions related to credit risks, new clients and companies they perceive as high risk that could default on their loans.

It is extremely important that business owners understand how lenders view the economy and in particular how those lenders may assess their business.

The professionals at Revitalization Partners are frequently involved in helping clients find new lenders or refinance existing credit lines.

Our experience in the second half of 2019 is similar to the shift in lender sentiment reflected in Q3 survey. In particular, there are many lenders with a significant amount of capital competing for disproportionately fewer deals.

While this has been consistent for the past few years, we have seen an increasing reluctance to compete for deals for companies that have experienced difficulties within the prior three or four years.

While this has been consistent for the past few years, we have seen an increasing reluctance to compete for deals for companies that have experienced difficulties within the prior three or four years.

While these companies are currently profitable, their historical experience has played a larger factor in a lender’s decision than it has in the past.

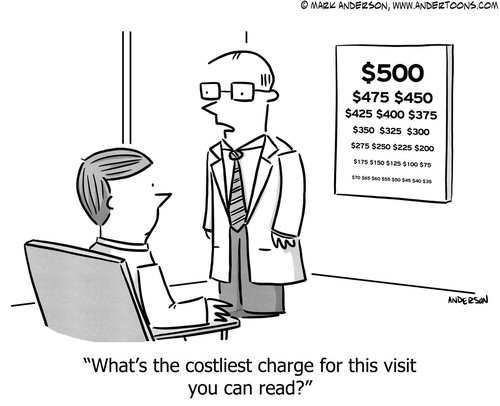

CURRENT LENDER SENTIMENT …

So, given the current lender sentiment, how should business owners proactively plan for their working capital needs, including their credit line requirements from current or potential lenders?

First of all, it’s important to focus on the health of your business. Companies that are consistently profitable will be more appealing to lenders than companies that have an inconsistent history of profitability.

First of all, it’s important to focus on the health of your business. Companies that are consistently profitable will be more appealing to lenders than companies that have an inconsistent history of profitability.

It’s also important to understand what level of liquidity is required to operate your business. Liquidity is defined as cash on hand plus borrowing capability.

The level of liquidity required to operate an efficient business is different depending on the capital structure and seasonality of a business.

The level of liquidity required to operate an efficient business is different depending on the capital structure and seasonality of a business.

If your current credit lines are not sufficient to achieve your company’s, liquidity goals, you should develop an updated financial plan and discuss your needs with your banker.

If for some reason, they are not in a position to accommodate your requirements, don’t be afraid to look for other lenders that may be in a position to better meet your requirements.

After going through this process, you may in fact find that your current lender might change their view and in fact offer a program that fits your requirements.

If you have questions regarding how you should go about positioning your company to determine the optimal level of liquidity or how to find a lender that will meet your needs, let us know and we would be happy to discuss your business requirements.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.