Our appreciation to the Calibre Group, a Pittsburgh, PA private equity group providing advisory services and direct investment, specializing in manufacturing and metals, for providing much of the information in this blog.

As we all know, companies have been hit hard by the economic downturn caused by the global health pandemic and subsequent nationwide shutdowns.

As we all know, companies have been hit hard by the economic downturn caused by the global health pandemic and subsequent nationwide shutdowns.

During this downturn there has been a lot of focus on weak demand and labor issues. But one issue that deems to have gotten less focus is trade credit insurance or lack thereof.

Many companies directly and indirectly rely on trade credit insurance to support operations. It is an insurance product that is vital in helping buyers and sellers conduct transactions in a smooth and efficient manner. Without trade credit insurance, the flow of goods between buyers and sellers could be restricted by a lack of confidence and liquidity.

ACCESS TO LIQUIDITY …

As the prices of goods continue to rise, the access to liquidity becomes more important for companies. The increase in prices combined with poor financial results during the pandemic, will lead banks to become more wary in extending credit to their borrowers.

As such, banks are going to be more focused on the collateral value of the borrowers.

As such, banks are going to be more focused on the collateral value of the borrowers.

For companies that have struggled during the pandemic, banks may be inclined to require inventory appraisals. And the banks may lean on appraisal companies to find reasons to recommend lowering advance rates. One way to do this is appraisers estimating longer liquidation times due to real sales volumes.

This means higher liquidation costs and net liquidation values. In order to accommodate the reduction in net orderly liquidation value as a percentage of cost, lenders will lower inventory advance rates.

AS ADVANCE RATES GET LOWERED …

As inventory advance rates get lowered, it will be critical for companies to continue to receive high advance rates on their accounts receivable, while also being able to extract longer terms on their accounts payable.

In many cases, AR advance rates and terms on AP are driven in part by trade credit insurance.

In many cases, AR advance rates and terms on AP are driven in part by trade credit insurance.

Banks will provide higher advance rates on insured receivables. Likewise, if a vendor can get higher advance rates, they will be more lightly to provide extended payment terms.

However, what we are hearing from contacts at banks and insurance brokers, is that in this time of need, trade credit insurers have declined to issue new policies or have tightened coverage significantly. Some insurers that are offering coverage are reducing coverage limits.

SENIOR LENDERS GET NERVOUS …

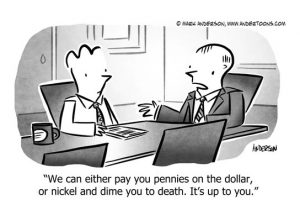

In times of turbulence and uncertainty, senior lenders tend to get nervous. When they get nervous, they almost immediately focus on downside protection. This typically results in increasing blockers/reserves and finding reasons to lower implied  advance rates. Lower implied advance rates come in two forms: (i) lower advance rate percentage, and (ii) changes to “eligible” collateral.

advance rates. Lower implied advance rates come in two forms: (i) lower advance rate percentage, and (ii) changes to “eligible” collateral.

With regard to accounts receivable, banks traditionally have standard definitions of what constitutes an ineligible receivable. These are typically receivables from offshore customers, contras/receivables subject to set-offs, cross-aged, significantly past due, and concentration.

Occasionally banks may also restrict advance rates on customers with deemed credit risk. However, in some cases borrowers can get their banks to advance on certain “ineligible” receivables if they have credit insurance (effectively converting ineligible collateral to eligible collateral). Additionally, there are many instances where uninsured receivables may get an 80-85% advance rate, while insured receivables may get a 90% advance rate. Depending on the premium cost of the insurance, this can be attractive to certain companies.

TRADE CREDIT INSURANCE DRYING-UP …

With trade credit insurance drying up, there are many companies, particularly those with high customer concentration or international customer and/or vendor exposure that may see their liquidity evaporate in the near-term. A company that  typically carries $10 million of receivables, of which 25% are insured, could see its borrowing base decline by between $250 thousand and $2.25 million. In normal circumstances this would be problematic, but it is exacerbated when liquidity is already weak, inventory advance rates are being reduced, and prices are on the rise.

typically carries $10 million of receivables, of which 25% are insured, could see its borrowing base decline by between $250 thousand and $2.25 million. In normal circumstances this would be problematic, but it is exacerbated when liquidity is already weak, inventory advance rates are being reduced, and prices are on the rise.

In addition to lower implied AR advance rates, the lack of trade credit insurance is also detrimental on the purchasing side. Just like you are concerned about your customers, your suppliers are concerned about you. If you are normally able to get 60-day terms from your material vendors, you may find those being reduced to 30 days in the absence of their ability to get insurance on you. A company that makes $50 million of material purchases per annum, would see its liquidity reduced by $4.1 million in that scenario.

IMPERATIVE TO MAINTAIN …

As a company owner or executive, it will be imperative to maintain excess liquidity given the uncertain times, and the potential reduction in advance rates from inventory appraisals and lack of trade credit insurance, coupled with a need to increase inventory purchases.

As a company owner or executive, it will be imperative to maintain excess liquidity given the uncertain times, and the potential reduction in advance rates from inventory appraisals and lack of trade credit insurance, coupled with a need to increase inventory purchases.

For opportunistic companies with ample liquidity, the next few months may present an opportunity to acquire competitors that run into liquidity issues or acquire assets from companies that need the capital to survive a liquidity squeeze.

CONTINUING TIGHTENING …

Lastly, we do not believe banks have fully countenanced the impact of the pandemic on their performance. There have been prohibitions on residential real estate foreclosures and landlords have not been allowed to evict delinquent tenants.

Lastly, we do not believe banks have fully countenanced the impact of the pandemic on their performance. There have been prohibitions on residential real estate foreclosures and landlords have not been allowed to evict delinquent tenants.

Building owners have foregone rental payments across all sectors including retail while the work from home initiative stands to leave swaths of commercial office space barren.

Banks anxiety to control loss is likely increasing, with continuing tightening of liquidity requirements.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.