There is no doubt that real estate turnarounds can be laden with high emotion and drama.

Dealing with that emotion and drama usually requires more experience and energy than all the technical challenges of real estate, no matter how good or bad the market conditions are.

But…there are tools that can be used with this social side of real estate.

This blog post describes two that have worked in several situations involving large properties.

A LOT OF EMOTION …

It is important to recognize that the nature of real estate means that there is frequently a lot of emotion tied up in it. First of all, it is tangible, and property is often a symbol of success.

The warehouse in question may be where Granddad started the family business.

The warehouse in question may be where Granddad started the family business.

The new office building was to have been the shining new company headquarters.

That high-rise apartment building was going to be the best in town.

ALMOST ALWAYS INVOLVES DEBT …

Second, real estate is capital intensive.

Second, real estate is capital intensive.

Its development or acquisition almost always involves debt, and the equity partners are frequently family or friends who have invested on faith.

There may be personal guarantees out to banks or lenders.

And the individual who made the loan may be fearful about losing his or her job should anything go wrong.

LONG AND INVOLVED PROCESS …

Third, compared with many kinds of business activity, real estate development is usually a long and involved process, one that requires progressively more time and emotion as you move through it.

Third, compared with many kinds of business activity, real estate development is usually a long and involved process, one that requires progressively more time and emotion as you move through it.

Ask someone about the progress of their project, and they probably have a rendering of it stored in the corner ready to pull out.

They might have spent a long day sitting and waiting to testify at a planning commission meeting, or have held a shockingly expensive groundbreaking event.

The marketing materials probably shine with a story yet to be realized.

AN UNCERTAIN FUTURE …

By the time there is need for a turnaround, all these hopes and ambitions are still present, but now the future is uncertain and holds fearful prospects.

By the time there is need for a turnaround, all these hopes and ambitions are still present, but now the future is uncertain and holds fearful prospects.

Who wants to let go of their dream? People can feel alone and trapped.

What is offered here may sound like two very modest tools for use at the very beginning of the turn-around process, when all these emotions are at their peak, things are most uncertain, and there is not yet a path to the future.

Together, however, they begin to create that path to the future, one grounded in the past and present.

TWO HELPFUL TOOLS …

1. A DETAILED HISTORY: The first is writing down a detailed history of the project, usually filling up a page or two, that provides a chronology of who did what when and with how much what money.

1. A DETAILED HISTORY: The first is writing down a detailed history of the project, usually filling up a page or two, that provides a chronology of who did what when and with how much what money.

This might include, for example, the date and amount of the first option payment, when purchase of the property closed and with whose funds, how much was spent on planning and approvals, the cost and length of construction, and the various lenders involved.

It sounds simple but writing this history can be both useful and therapeutic. Beyond the fact that the receiver or others will need it, this history requires a detailed sharing of information, something many that borrowers living in fear may have grown loath to do.

This tells their story, both the good and the bad, and puts different issues in perspective. This history also tells you what technical reports you can now store away not worry about.

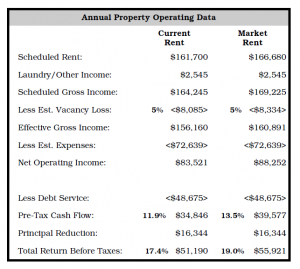

2. A PROFORMA MODEL: The second tool is a pro forma model of the sources and uses of cash for the project.

2. A PROFORMA MODEL: The second tool is a pro forma model of the sources and uses of cash for the project.

This shows, over time, where the money came or will come from (such as equity, debt, operating income and disposition), and what it has been or will be used (such as land acquisition, design, construction, leasing and loan repayment.)

Ideally, this is all one page, and probably covers somewhere between two and five years of cash flows.

REMOVE EMOTION …

The fact that this is a table of numbers itself takes some of the emotion out of the discussions. There is no architect at the table to defend his plan, no broker eager for a steady stream of leasing commissions.

The fact that this is a table of numbers itself takes some of the emotion out of the discussions. There is no architect at the table to defend his plan, no broker eager for a steady stream of leasing commissions.

Putting together the numbers does require the borrower and lender to quantify their assumptions about what will add value to the project, what it will be worth at various stages of completion, and how long things will take.

That, in itself, moves the discussion from the past to the future, from “Where did I make a mistake?” to “How do we move forward?”

EARLY STAGES …

We are now in the early stages of a recession that, according to many in real estate, we were due for a year or two ago.

We are now in the early stages of a recession that, according to many in real estate, we were due for a year or two ago.

Because the onset was so abrupt and the future is so uncertain, emotions are going to run higher than ever on distressed real estate.

The borrowers and lenders that can come together now and work out a strategy will have more options and will recover more than those who wait.

These tools are one way to deal with the emotions that often keep people from starting that process.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.