Nothing makes media headlines faster than jaw-dropping executive incentive payouts and/or retention bonuses paid prior to a company’s bankruptcy filing.

Nothing makes media headlines faster than jaw-dropping executive incentive payouts and/or retention bonuses paid prior to a company’s bankruptcy filing.

Within this context, the impact of COVID-19 has been uneven across sectors and has contributed to poor performance across various industries.

Some sectors, like retail, were already challenged, J.C. Penney, Neiman Marcus, J. Crew and more teetered on the edge of solvency. With more than 18 months of the pandemic behind us, other casualties include airlines, hotels, car rentals, movie theaters, theme parks, and any other business, large and small, that brings people together in crowds. Many companies are in survival mode. Some will live. Some will die.

RESTORING SHAREHOLDER VALUE …

But prior to filing for bankruptcy, and as companies prepare to emerge from bankruptcy, there is an important consideration: the ultimate restoration of shareholder or stakeholder value.

But prior to filing for bankruptcy, and as companies prepare to emerge from bankruptcy, there is an important consideration: the ultimate restoration of shareholder or stakeholder value.

The retention of key executives or bankruptcy savvy interim executives can be of critical importance during this extraordinary period. But the real question is, what types of bonuses make sense prior to a bankruptcy filing, and how should companies manage the optics with stakeholders?

A recent Reuters analysis of securities filings and court records identified 32 of 45 companies that paid out bonuses in the six-months prior to filing for bankruptcy, with nearly half making the payouts within two months of filing.

Several companies made large bonus payments, often while furloughing or laying off employees, before their bankruptcy filings.

For example,

- J.C. Penney Co., Inc. approved close to $10 million in payouts just before its May 15 filing while furloughing approximately 78,000 of its 85,000 employees

- Hertz Global Holdings, Inc. paid executives $1.5 million after having terminated over 14,000 employees before its May 22 filing

- Whiting Petroleum Corp. paid $14.6 million in extra compensation to executives before its April 1 filing

- Chesapeake Energy Corp. paid $25 million to executives and other employee in May, about two months before its filing.

IS IT APPROPRIATE?

Is the payout of a large bonus appropriate when so many people have lost their jobs, creditors go unpaid, and shareholders lose money?

Companies often pay bonuses before filing for bankruptcy due to the legal constraints on how executive compensation may be paid once the company is in bankruptcy (e.g., negotiations with creditors and the court, court approval, etc.)

The merits of bonuses often go beyond lining the pockets of executives and may instead be tied to short-term incentive bonuses for the prior year based on actual performance achieved, or long-term performance awards that happen to vest in the year of the downturn.

There may even be retention bonuses that encourage executives with the right skillsets to remain with the company, help get the company back on the road to survival, and ultimately realign executive and shareholder interests.

But regardless of the reasons, the optics of such payments in the face of the pain to employees and creditors can do significant damage to a company’s ability to successfully exit Chapter 11.

AVOID SINKING SHIPS …

Very few people want to be associated with a “sinking ship” and yet there is an entire industry that is dedicated to providing the best management to distressed companies.

Very few people want to be associated with a “sinking ship” and yet there is an entire industry that is dedicated to providing the best management to distressed companies.

And those “restructuring” executives have often seen and managed through a number of situations enabling them to minimize cost and time in the process while the company executives are just learning about insolvency and the bankruptcy process.

While keeping executives engaged during a bankruptcy can mean the difference between success and failure, these other options may be less costly to and more effective for the company and stakeholders than large bonus programs.

Boards do need a motivated, capable group to get the company back to solvency and profitability but rewarding the executives that led the company into the problem may not be the ideal solution.

BONUSES EMBRACED WHEN THEY …

Bankruptcy is not the only scenario where retention bonuses can have a role in overall compensation. Retention bonuses can also be effective in retaining and motivating talent during other periods of disruption.

Since a wide variety of stakeholders always scrutinize any type of executive retention bonus, the payouts are more likely to be embraced by investors and proxy advisors when they meet the following criteria:

Since a wide variety of stakeholders always scrutinize any type of executive retention bonus, the payouts are more likely to be embraced by investors and proxy advisors when they meet the following criteria:

- Pay out or vest after a defined period of time (e.g., two to three years)

- Consider awards within the context of normal pay for the recipient (e.g., up to 0.5x to 1x salary, delivered in cash and/or equity, or up to 0.5x annual equity)

- Include performance measure(s) and/or a minimal performance hurdle before payout or vesting

- Focus awards only on executives and employees whose departure would have a significant impact on the company’s performance.

HEADLINE GRABBING OPTICS …

Paying bonuses to executives prior to filing for bankruptcy is not new. What is new is the extraordinary focus by stakeholders on Environment, Social and Governance (ESG) issues.

Paying bonuses to executives prior to filing for bankruptcy is not new. What is new is the extraordinary focus by stakeholders on Environment, Social and Governance (ESG) issues.

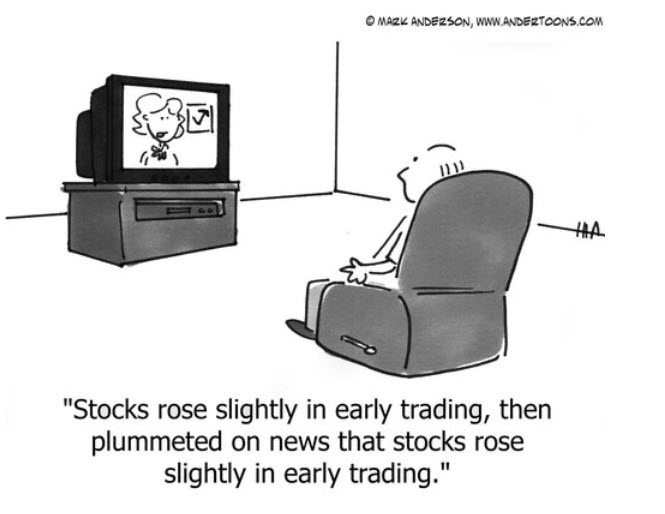

This has now become a headline-grabbing, optics challenge that falls squarely on the “S” in ESG. While companies have blamed COVID-19 as a major contributor to their companies’ performance challenges, COVID-19 has really been the catalyst that continues to highlight the many social issues affecting the most vulnerable in our society.

And paying large executive bonuses from an insolvent company while conducting layoffs, exacerbates the company’s problems.

From health risks to pay inequality, the pandemic has provided a new lens for all stakeholders to opine on executive pay and to encourage a more holistic look at how all of a company’s stakeholders are being treated, including employees, suppliers, communities where the company does business, and shareholders.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.