There is no question that the high rate of inflation, supply chain challenges, and higher interest rates, have taken their toll on businesses over the past few years.

There is no question that the high rate of inflation, supply chain challenges, and higher interest rates, have taken their toll on businesses over the past few years.

Many businesses have found creative ways to deal with these challenges, however, there are a number of businesses that have not made significant changes and are merely waiting for business conditions to improve.

HEAVY INFLUX OF FUNDS …

The heavy influx of funding from the federal and state governments have certainly helped businesses cope with these challenges; particularly since a number of the loan programs allowed for the loans to be forgiven if certain conditions were met.

The heavy influx of funding from the federal and state governments have certainly helped businesses cope with these challenges; particularly since a number of the loan programs allowed for the loans to be forgiven if certain conditions were met.

There was an expectation that these federal and state programs would assist businesses by injecting cash into the business to weather the COVID storm. It was assumed that as business issues associated with the pandemic began to subside, demand for goods and services would increase.

Furthermore, banks were given leeway by the Federal Reserve to defer loan payments for an extended period of time, which provided additional relief to businesses suffering from the impact of COVID.

LOAN PROGRAMS HAVE ENDED …

However, now that the federal and state loan programs have ended and banks are no longer deferring payments, businesses can no longer rely on these programs to support their operations.

However, now that the federal and state loan programs have ended and banks are no longer deferring payments, businesses can no longer rely on these programs to support their operations.

As a result, there are a significant number of businesses that continue to struggle and/or have shut down as a result of their inability to make the appropriate operational changes in response to changing customer behavior.

The most recent U.S. Bureau of Labor Statistic report for the month of August reported that 1.9 million persons lost their jobs because their employer closed or lost business due to the pandemic.

While this is an improvement from the prior month, this statistic represents the significant long-term consequences for businesses unable to cope with the impact of COVID.

SOME WAITED TOO LONG …

There are other signs that a number of businesses have waited too long and are facing tough choices to survive, or worse, they are facing either a lender or creditor forced bankruptcy/receivership or liquidation.

There are other signs that a number of businesses have waited too long and are facing tough choices to survive, or worse, they are facing either a lender or creditor forced bankruptcy/receivership or liquidation.

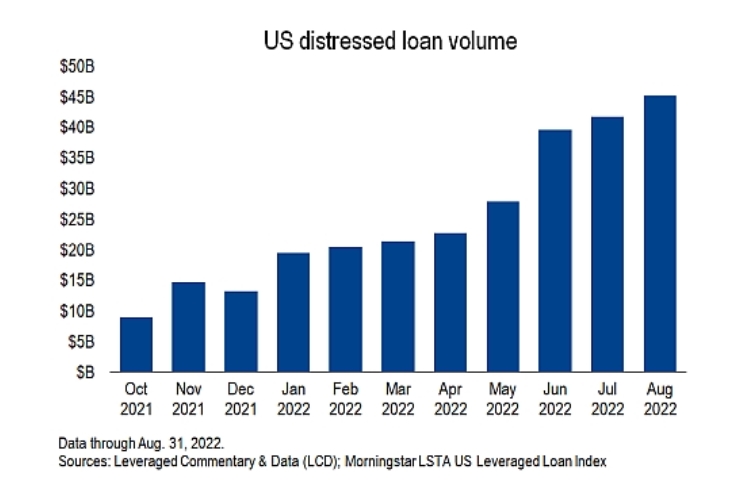

For example, default activity in the U.S. leveraged loan market increased significantly in August. Coming off of historic lows, the dollar value of defaults doubled from July to August according to the Morningstar leverage loan index.

Furthermore, the value of US distressed loans has more than doubled since January 2022. Another important indicator is the number of August commercial bankruptcy filings which increased 16% over the previous month.

LENDERS INCREASING SCRUTINY …

Businesses that continue to incur cash flow deficits need to find ways to rapidly makes changes or face the prospect of losing their business. Particularly, if they are highly leveraged.

Businesses that continue to incur cash flow deficits need to find ways to rapidly makes changes or face the prospect of losing their business. Particularly, if they are highly leveraged.

Lenders have increased their scrutiny of businesses, particularly those having declining profits, or losses, given the changing environment of frequent loan defaults and the increasing level of bankruptcies and receiverships.

They are, in fact, taking significant action earlier as they start to see early signs of business distress or violations of financial covenants.

PROACTIVE MANAGEMENT NECESSARY …

It is really important in this business environment for management teams to be proactive in addressing operating challenges earlier in the business cycle.

It is really important in this business environment for management teams to be proactive in addressing operating challenges earlier in the business cycle.

- They must frequently review key financial indicators relating to revenue and profit compared to the prior year, and, if there is a consistent month to month decline, work to develop plans to improve performance.

- Management must also take a proactive approach in communicating with their lenders and if necessary, with key vendors.

- Providing an overview of the business from a financial perspective, including financial projections, along with a written plan to improve performance will go a long way to instilling confidence with key creditors.

SEEK EXPERIENCED PROFESSIONAL HELP …

If management is unable to execute timely changes to improve performance, it is important to seek advice from experienced professionals, such as a turnaround professional and/or insolvency attorneys.

Staying ahead of the process and maintaining control of the business, regardless of the outcome, will provide a better result for the stakeholders, rather than deferring to lenders or creditors that could potentially force a solution that may not be in the best interest of the responsible parties.

Staying ahead of the process and maintaining control of the business, regardless of the outcome, will provide a better result for the stakeholders, rather than deferring to lenders or creditors that could potentially force a solution that may not be in the best interest of the responsible parties.

Management is at significant risk, both from a business and personal perspective, if they wait too long to deal with declining cash flow.

Maintaining control of the business throughout the process is vitally important so management can be informed and empowered to take steps to possibly mitigate risks.

And early in this process, don’t be afraid to ask for help to improve the odds for success.

Revitalization Partners specializes in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations. Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering, a State Receivership or Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.