It may be an offer from Africa, Europe, or even in the United States. But the offer is pretty much the same.

It may be an offer from Africa, Europe, or even in the United States. But the offer is pretty much the same.

You have a business and you want to sell. You’ve talked with investment bankers and perhaps business brokers and they’ve informed you that the business is not really “salable”, especially for what you believe it’s worth.

Perhaps you’ve lost money for a significant period of time. Maybe the asset base of the business has deteriorated. Or you’re just tired and ready to get out.

But Here Comes An LOI …

And then, along comes a “Buyer” with a serious Letter of Intent (LOI).

And then, along comes a “Buyer” with a serious Letter of Intent (LOI).

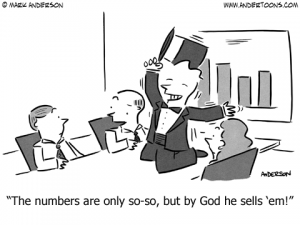

This LOI makes you an offer that almost knocks your socks off. The amount represents more than your advisors told you that you would probably receive. And, of course, it’s an offer to purchase your stock or equity, despite that more than 90% of small and mid-sized business sales represent a sale of assets.

As a result of this Non-Binding LOI, you begin to send paperwork so that they can understand your business. You may have requested and received a Non-Disclosure Agreement. A non-disclosure agreement is only as useful as it is enforceable. If the potential buyer improperly uses the information you provided, are you going to bring legal action against them in Europe or Africa?

You Don’t Need An Advisor …

And assuming that you have retained advisors to assist you, the “Buyer” suggests that the advisors will “only slow this deal down or mess it up” is a common statement from an experienced scammer to an inexperienced seller.

And assuming that you have retained advisors to assist you, the “Buyer” suggests that the advisors will “only slow this deal down or mess it up” is a common statement from an experienced scammer to an inexperienced seller.

Another common request applies to due diligence. Revitalization Partners sold a business in receivership to a vendor. The vendor was over 3,000 miles away from the company. And yet, they insisted on completing their due diligence by coming out to the company and addressing all of the issues in person.

Contrast that to the potential Buyer that suggests that you just send him all your books, contracts and records.

Especially, as we have seen in one case, the proposed Buyer was outside the United States.

In another case, our client received an LOI from what purported to be an investment group, located outside the United States and having ownership of over a dozen companies.

In researching this group, we could not find a single piece of information relating to any of this companies.

Another Common Scam …

Another common scam is where the “Buyer” goes through the process and at closing, the amount of money agreed on is not quite there.

Another common scam is where the “Buyer” goes through the process and at closing, the amount of money agreed on is not quite there.

It is a bank screw up or “the check is in the mail and must have been delayed.”

But because all of the closing documents are ready to go as of the closing date, let’s just go ahead and close since the money is only “a day or two away.”

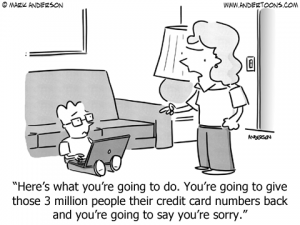

Once the Buyer has control of the company, they strip the assets and cash and disappear, leaving the Seller with nothing or only a small deposit.

Think no one falls for this? Think again!

There were at least two groups that worked this for years before being arrested by the FBI.

How To Protect Your Company …

So, what are some of the ways that you can protect yourself if you are contemplating a sale of your company?

1. Perform an extensive background check on any potential buyer, including a review of the person’s or company’s banking references, credit reports, litigation history, tax liens, and, if they have purchased other companies, obtain references from the former owners of companies they have purchased.

1. Perform an extensive background check on any potential buyer, including a review of the person’s or company’s banking references, credit reports, litigation history, tax liens, and, if they have purchased other companies, obtain references from the former owners of companies they have purchased.

2. Beware of sales that go too smoothly. Legitimate buyers will perform due diligence, asking tough questions, inspecting financial records, and calling customers and vendors. If the buyer wants to close the sale in a hurry, beware! And NEVER send due diligence information to a buyer based on an LOI. Either they can come to you or, there are ways to establish a data room where the data can be reviewed but not copied or downloaded.

3. Make certain that any LOI contains a non-solicitation clause. This clause does not allow the potential buyer to hire any of your employees should the deal not complete.

4. The buyer must meet deadlines and supply all requested data in a reasonable time. If he or she is always late, move on. Find a buyer who’s serious about the transaction.

Remember That You …

Remember that you typically only sell your business once.

Remember that you typically only sell your business once.

Make sure that you get your advisory team in place early and involve experienced business advisors and an experienced business attorney as part of that team.

They may save the value of your business.

And finally, if it is “Too Good to be True”, it usually is!

Revitalization Partners is a Northwest business advisory and restructuring management firm with a demonstrated track record of achieving the best possible outcomes for our clients. And now, we’ve written a book to help our readers understand the issues facing their businesses. You can find this compilation of our business thoughts at: https://revitalizationpartners.com/we-could-write-a-book/ or on Amazon.

We specialize in improving the operational and financial results of companies and providing hands-on expertise in virtually every circumstance, with a focus on small and mid-market organizations.

Whether your requirement is Interim Management, a Business Assessment, Revitalization and Reengineering or Receivership/Bankruptcy Support, we focus on giving you the best resolution in the fastest time with the highest possible return.